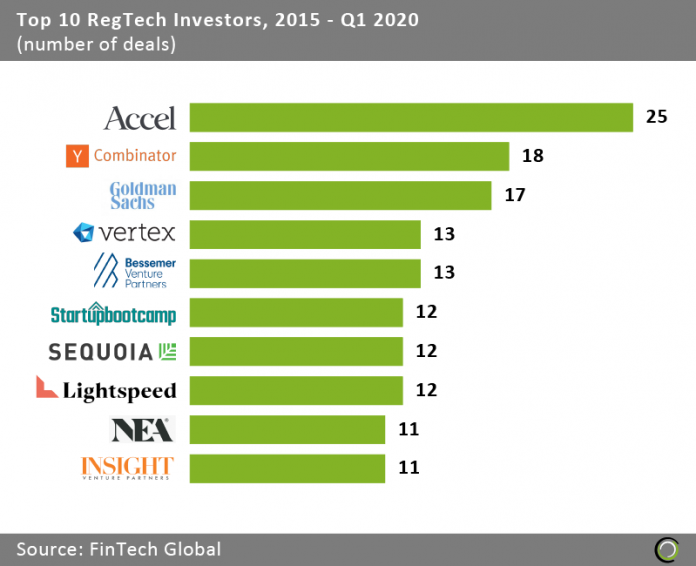

Accel has been the most active backer of innovative RegTech and information security companies with 25 investments since 2015

- The potential size of the global RegTech market is large enough that some of the major brand name venture firms have backed RegTech companies in the belief that they can grow into multi-million dollar companies. Indeed, VC firms take seven spots on the list of the top ten RegTech investors since 2015.

- Accel has been the most active investor in the industry participating in 25 funding rounds. The firm’s founder Andrei Brasoveanu recognises the scope of the opportunity and implicitly added RegTech as one of the main investment areas of Accel’s last fund. The company most recently participated in the $80m Series C round raised by Privitar, a data privacy platform.

- Surprisingly, there is lack of presence from financial institutions among the top investors in the market. Only Goldman Sachs takes a place on the list with 17 deals. The bank seems to realise that to hold its market leading position it needs to actively invest and be at the forefront of new digital innovation. Goldman most recently backed Very Good Security, a data security, compliance and privacy platform, in February. Goldman had previously participated in Very Good Security’s $35m Series B round in October 2019.

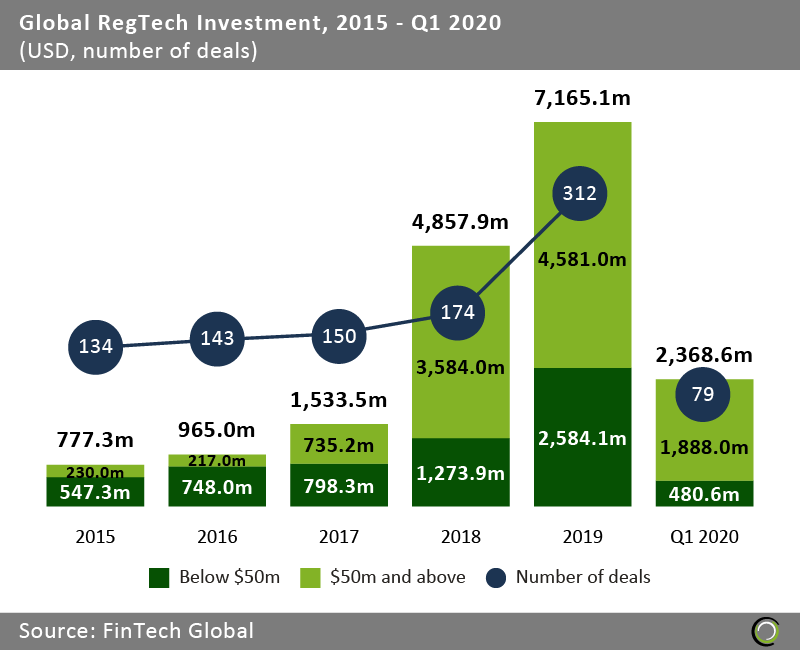

Global RegTech funding had a strong start to 2020 driven by large deals over $50m

- Global RegTech investment between 2015 and 2019 rocketed as investors increasingly backed companies looking to solve and bring efficiency to outdated compliance processes as well as take advantage of the new complex regulations coming into effect such as MiFID II and GDPR. Total funding grew at a CAGR of 74.2% over the period from $777.3m to over $7.1bn at the end of last year.

- It seems the coronavirus pandemic had little impact on investors’ appetite in the RegTech market as funding reached nearly $2.4bn in the first three months of 2020, a 3.8x increase compared to the same period last year. The massive capital growth was mainly driven by 13 deals valued at $50m or more, compared to just three such transactions recorded in Q1 2019. The largest deal of the period was raised by Netskope, a software provider helping companies secure data and protect against threats in cloud applications, which raised $340m in a Series G round in February.

- If we leave the volatile quarter to quarter large deals, the RegTech sector still saw strong levels of deal activity with 79 transaction completed in the opening quarter of 2020. That’s a 38% growth compared to Q1 last year.

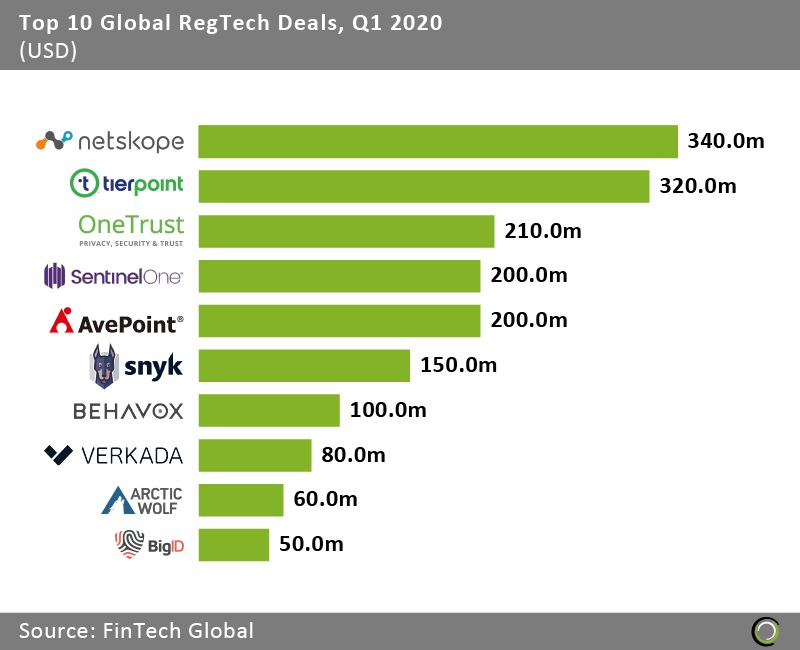

Nine of the top ten RegTech deals completed in Q1 2020 were Series C or beyond as the RegTech market matures

- The top ten RegTech deals in the first three months of 2020 collectively raised just over $1.7bn, making up 72.2% of the overall investment in the sector during the quarter. The ratio is higher than the one recorded in Q1 2019 when 66.5% of total funding came from the largest ten transactions. This is to be expected as established RegTech companies raise late-stage rounds of funding to fuel international expansion and acquisition efforts.

- Indeed, nine of the top ten transactions in Q1 were classified as Series C or beyond. In comparison, the same number for the top ten deals in the opening quarter of 2019 stood at just three transactions.

- The only Series B deal on the list was raised by OneTrust, a privacy, security and trust technology platform, which collected $210m from Coatue Management and Insight Partners. The transaction valued the company at $2.7bn and the capital will be used to scale OneTrust’s services, support, and partner ecosystem globally and add new capabilities to the platform through both organic and inorganic innovation.

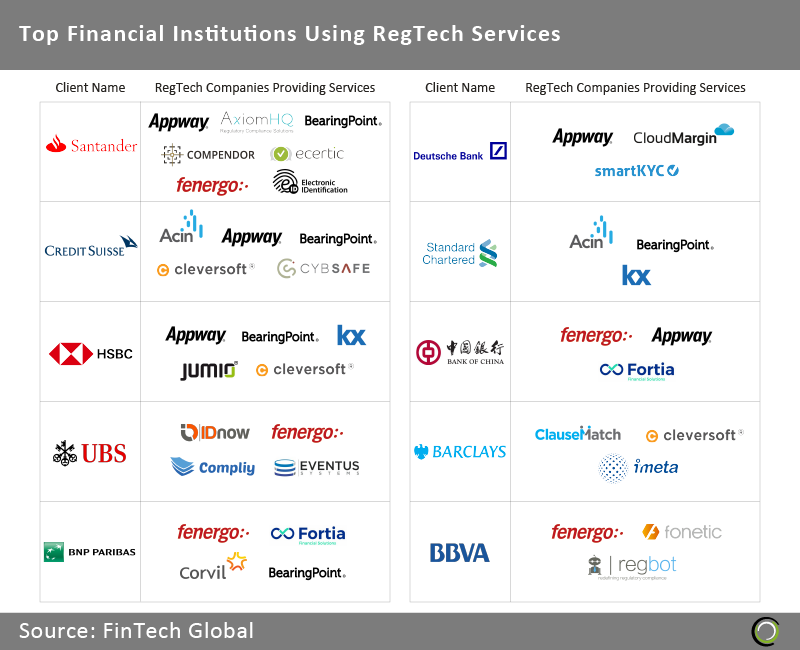

Even though Financial institutions are not actively investing in RegTech they are increasingly using their services

- During interviews with 170 RegTech companies it became apparent that RegTech is delivering on the promises and its services are actively employed by leading financial institutions globally. Despite banks and other financial services firms not being among the most active investors in the sector they do realise the cost efficiencies and operational improvements using RegTech services can bring.

- Retail and investment banks such as Santander, Credit Suisse, HSBC, UBS and BNP Paribas have taken industry leading positions in terms of transforming their organizations by striking deals with three or more regulatory technology providers. Santander is certainly ahead of the rest with seven RegTech solutions used by the firm.

- There appears to be no correlation between the size of bank or financial institution and the level of RegTech engagement. However, it is interesting to note that the major US banks are missing from the list. Due to the fragmented state legislations and lack of support from regulators, financial institutions across the Atlantic have been slow to adopt new technology services and prefer to innovate in house.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global