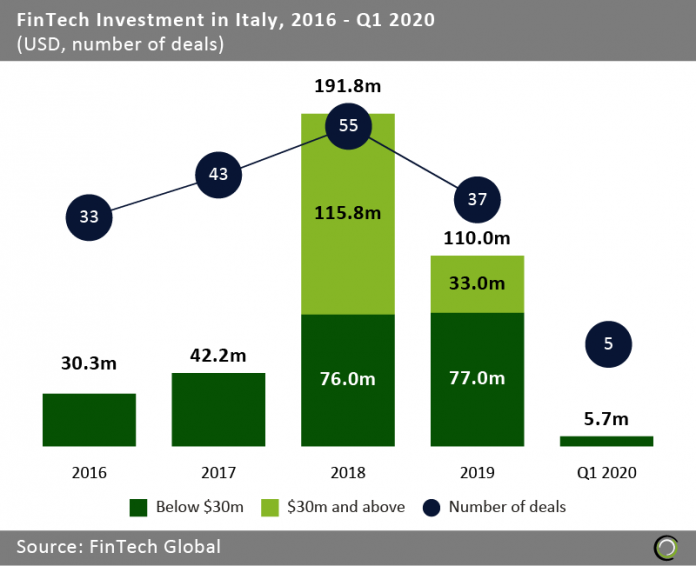

The country recorded only five deals in Q1 2020 and could be a sign of things to come for the European FinTech sector in the second quarter

- Italy’s FinTech industry witnessed strong growth between 2016 and 2018 with companies raising $264.3m across 131 deals. However, the sector experienced a pullback last year when funding declined by 42.6% to $110m from the record high of $191.8 reached in 2018.

- FinTech funding declined sharply during the first three months of 2020 with only $5.7m capital raised compared to $14.5m in Q1 2019. As the first coronavirus lockdown measures in Italy came in effect on 21 February, there was only one deal recorded after that date – proof of the negative effect the quarantine measures are having on deal activity.

- Worryingly, Q1 2020 saw only five FinTech deals completed in the country. That is 50% lower than the worst level of deal activity recorded since 2016 when ten transactions were completed in Q1 2018. If that rate continues for the rest of the year, then the Italian FinTech sector is on track to record its worst year since 2016 for both investment and deal activity.

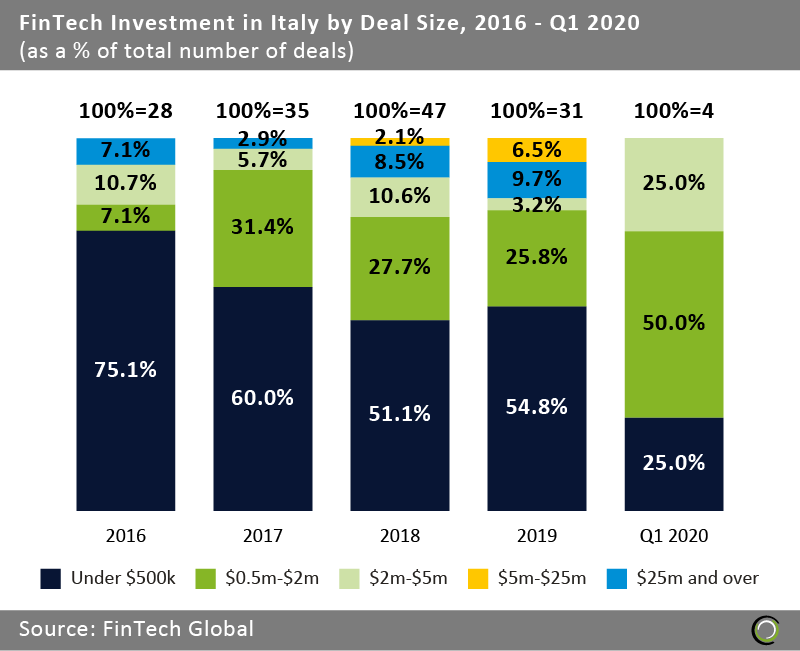

The high proportion of early-stage deals makes Italy’s FinTech industry vulnerable to downturns

- As the FinTech industry matured in Italy, the share of early-stage deals valued under $500k declined to 54.8% in 2019 from 75.1% in 2016. However, investors are still making relatively small and early-stage investments in the country with only five Series B rounds raised since 2016 and no Series C or later transactions recorded.

- The proportion of deals under $5m in Italy is way higher than in other countries in Europe. For instance, that share in the country stood at 83.9% in 2019 when in France, Germany and the UK it was 44.9%, 41.9% and 59%, respectively.

- As investors pull away from riskier early stage deals due to the uncertainty caused by coronavirus and the expected economic downturn, this leaves the Italian FinTech sector vulnerable to further decline in 2020. A significant number of companies could go out of business as they fail to secure follow-on funding.

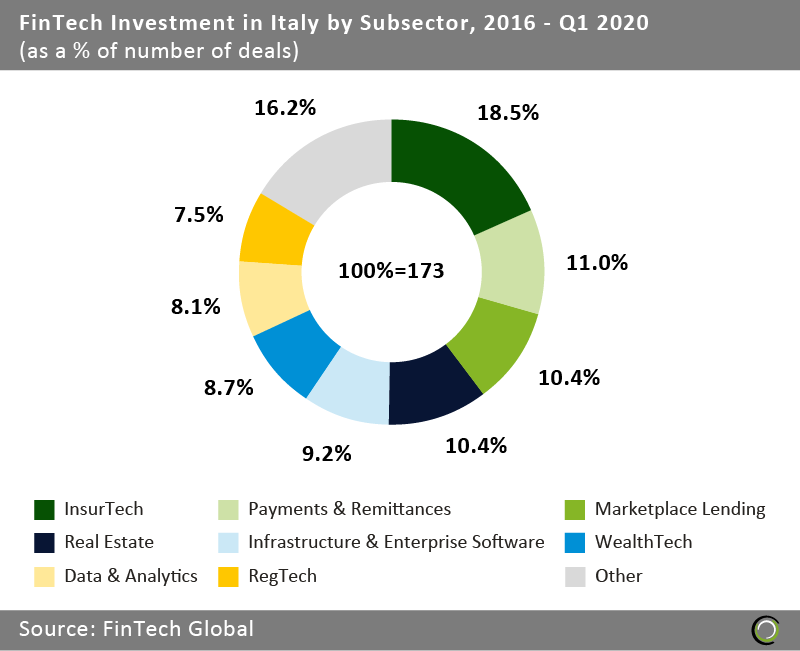

Italian FinTech companies across the value chain are attracting investment

- Italy has built a diverse FinTech ecosystem with all 11 sectors attracting investments and well-represented in terms of deal activity. In fact, no sector has collected over 20% of all transactions in the country since 2016.

- InsurTech companies attracted the most deals in Italy over the period, completing 32 funding rounds. With an aging population and state spending constraints expected to drive demand for property and casualty (P&C) and health insurance both banks and FinTech companies are taking advantage of the opportunity.

- Payments & Remittances companies also captured a healthy share of deals, accounting for 11% of deals in the country since 2016. Based on a survey by Fintech and Insurtech Observatory of the School of Management of the Milan Polytechnic, there are already 11 million users who have tried at least one FinTech service. The report shows that users mainly use Mobile Payments (16%) and services for instant money transfers between individuals (12%).

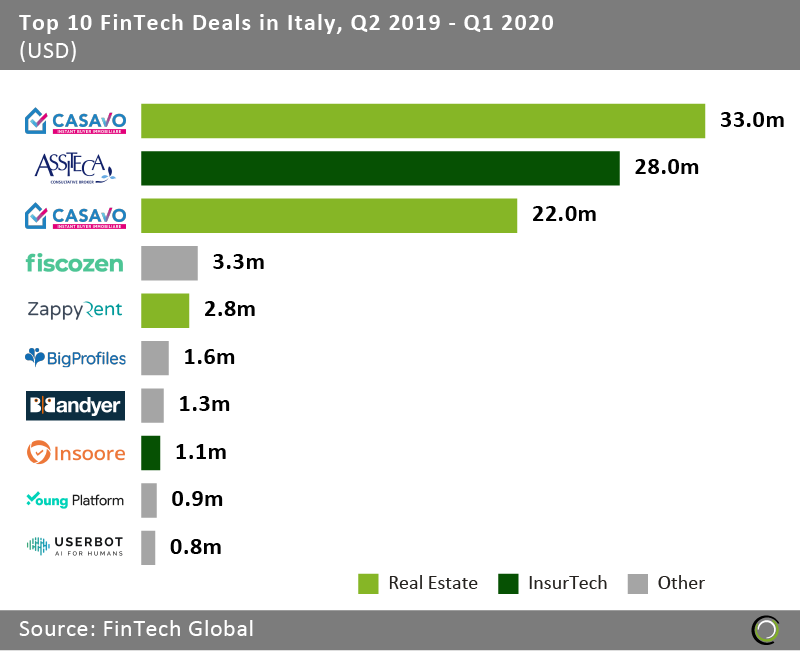

Real Estate and InsurTech companies completed five of the top ten deals in Italy in the last 12 months

- The top ten FinTech deals in Italy completed between 1 April 2019 and 31 March 2020 collectively raised $95m, making up 93.8% of the overall investment in the country during the period. The high levels of concentration of capital in large deals is normal given the high proportion of deals under $2m which stood at 80.6% last year.

- PropTech companies took three spots on the list with Casavo, a tech-enabled Real Estate transactions platform, taking the top spot. The company raised $33m in debt financing in October 2019 to further build it technology platform and expand to new markets.

- The second largest deal of the period was completed by Assiteca, an insurance broker offering technical risk management tools, which raised $28m in a private equity round in August 2019. The transaction was led by Tikehau Capital which acquired a 23.4% stake in the company.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global