Having been forced to sack several employees because of COVID-19, Sensibill has raised $5m in debt financing from CIBC Innovation Banking.

The exact number of employees laid off by the receipt management app Sensibill is unclear. Yet, a source told BetaKit that roughly a fifth of the company’s workforce had been made redundant. Sensibill declined to confirm the exact number to the publication.

BetaKit reported that the new debt financing is unlikely tied to layoffs as CIBC Innovation Banking is not in the business of bailing out struggling companies, but only offers growth capital.

Canadian Sensibill most recently raised $42m in a Series B round in July 2019, a round that brought the total raised by the company to $61m.

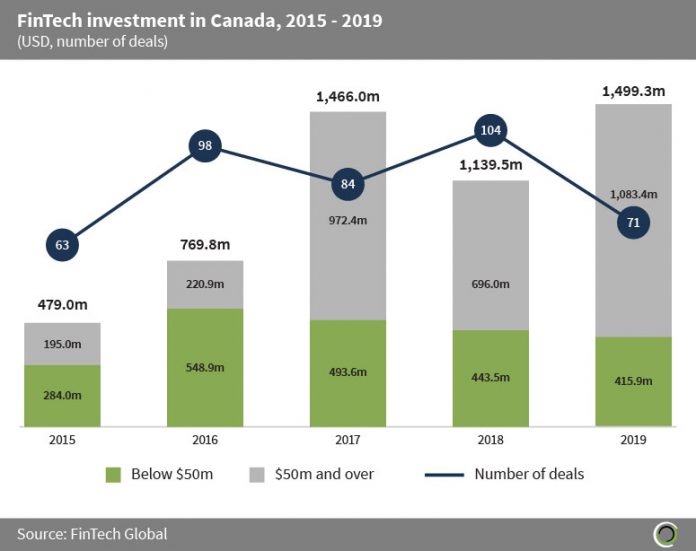

The round comes at a very interesting time for Canadian FinTechs. As FinTech Global has highlighted in the past, the nation’s industry raised over $5.2bn between 2015 and 2019 across 420 deals.

While there was a slight dip in funding in 2018, when the industry only raised $1.13bn compared to the $1.46bn in 2017, the industry bounced back in 2019 when it netted $1.49bn in investment.  However, the coronavirus pandemic has pushed the Canadian industry into disarray. In April, the National Crowdfunding & Fintech Association (NCFA) sent an open letter to the Canadian government, begging it to help the nation’s FinTech industry.

However, the coronavirus pandemic has pushed the Canadian industry into disarray. In April, the National Crowdfunding & Fintech Association (NCFA) sent an open letter to the Canadian government, begging it to help the nation’s FinTech industry.

“The Canadian government should recognise that FinTech companies can play a central role in distributing capital to small businesses and early-stage companies,” the open letter said. “Online lending and crowdfunding platforms have invested to build the software for onboarding, screening, approval, distributing and servicing of loans and investments to Canadian small businesses. Canada’s regulators and policymakers need to work with our FinTech entrepreneurs who have the digital infrastructure to help the Canadian government achieve its goal of saving small businesses and getting the economy get back on track faster.”

Copyright © 2020 FinTech Global