InsurTech-focused investment firm Eos Venture Partners has closed its latest vehicle to seek opportunities in the digitalisation of insurance caused by the coronavirus.

Total funds under management are $85m.

Investors to the Strategic InsurTech Fund include insurers and reinsurers from the UK, Europe, US, Canada and Asia. Tokio Marine and Direct Line Group are among the backers.

The investment firm backs InsurTech companies around the world. Eos believes the coronavirus is acting as a catalyst for change and will supercharge innovation within the insurance space.

Digital engagement, agility, flexible usage-based products, tailored pricing and remote claims assessments are expected to see rise in popularity, it claims.

Penny James, CEO of Direct Line Group said, “This partnership will give us a window into the trends developing around the world of InsurTech. We want to disrupt the market with new and innovative products and services for our customers and being part of Eos’ global innovation community will help us deliver this.”

The vehicle has already been tapped to make six investments, spanning the UK, US, China and India. These portfolio companies operate across the value chain including automated and AI assisted underwriting and claims and cover verticals such as small medium enterprises, global supply chains, sharing economy, motor and home.

Eos founding partner Carl Bauer Schlichtegroll said, “We are delighted to welcome Tokio Marine, one of the largest global property and casualty insurers and Direct Line Group, one of the UK’s leading personal lines and small business insurers to the fund.

“Having insurance partners from many of the leading insurance markets and across commercial and personal lines means that we have a powerful global innovation community.”

Earlier in the year, the firm invested into the $20m Series B of insurance software developer Concirrus.

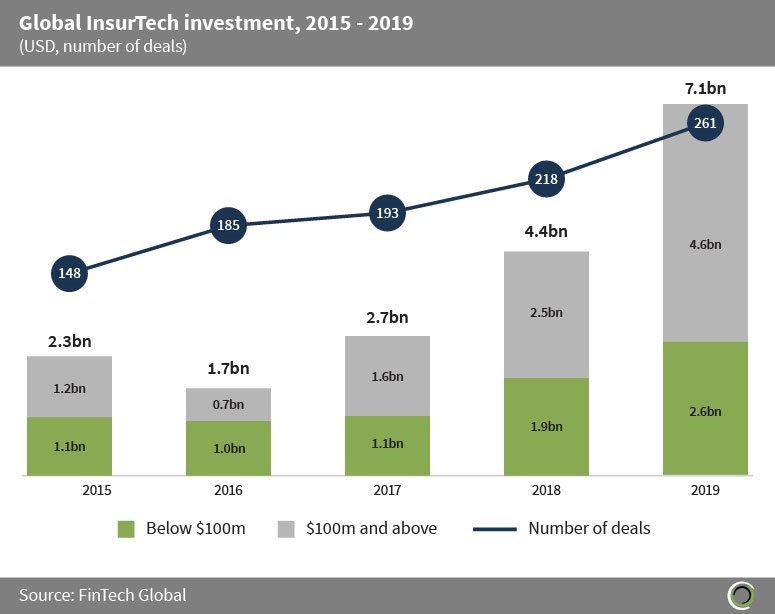

The InsurTech sector has seen a lot of attention from investors. Between 2015 and 2019, more than $18.9bn has been invested globally into InsurTech companies. Last year, saw a record for the amount of capital invested, with a colossal $7.1bn being distributed to companies building solutions in the sector.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global