Irish FinTech startup CreditLogic has reportedly raised €1.5m in its seed round and launched its new Virtual Assistance feature.

With the close of the investment, the FinTech has raised a total of €2.4m in equity, according to a report from Silicon Republic.

The capital will be used to accelerate the company’s product roadmap and help it to further improve the loan origination process.

Credit Logic leverages AI, open banking and analytics to help lenders and brokers streamline the consumer loan application process. The service, which is available as mobile and desktop apps, provides a real-time advisor case management tool for enquiry to loan completion. It also boasts automated consumer data and documentation review with advisor prompts.

The FinTech claims its technology can improve the customer experience, increase lead volumes and reduce processing costs.

In tandem with the round close, the company has released its Virtual Assistance tool. The new service will allow advisers and consumers to better collaborate on digital loan applications in real-time, the article said.

CreditLogic founder Eddie Dillon told Silicon Republic, “Social distancing means consumers no longer have the same access to their financial advisers. Virtual Assistance gives the adviser full visibility of the customer’s digital experience, allowing them to interact and provide real-time help from initial enquiry to mortgage completion.”

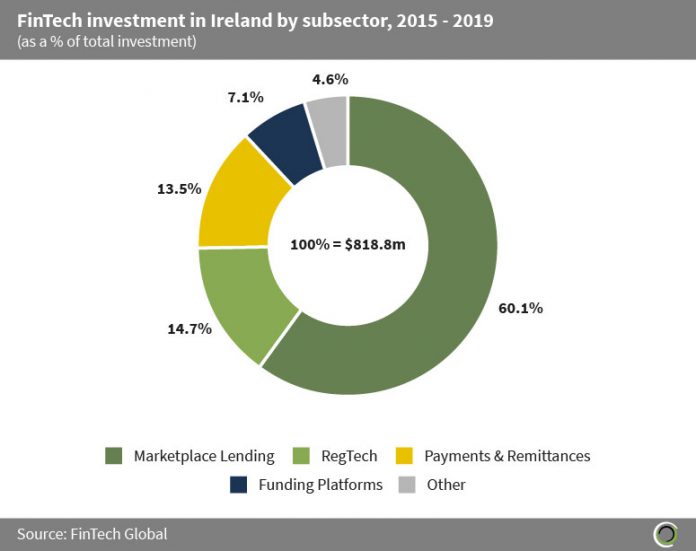

The marketplace lending sector is very popular in Ireland. Between 2015 and 2019, there has been a total of $818.8m invested into Irish FinTech companies, of which, 60.1% has gone to companies in the lending technology space.

The UK’s exit of the European Union has raise question marks over its position as the leader of FinTech in the region. Ireland is one of the countries which could become the new European powerhouse.

John Meehan, partner at Arma Partners (a financial advisor to the digital economy), said, “Whilst not as large as the UK and German markets, [Ireland] is an extremely attractive hub, particularly for B2B FinTech, with companies forced to have an international growth strategy from day one. Given the heavy focus on developing innovative, market-leading technology, we see a higher level of earlier stage M&A than we do in other core markets as strategics seek to acquire technology where they can level their sales infrastructure.”

Copyright © 2020 FinTech Global