Another week and another 29 FinTech companies have closed funding rounds, showing that capital can still be raised during these unprecedented times.

In the early days of the Covid-19 pandemic there were fears the market would see masses of downrounds, particularly the larger FinTechs. When UK challenger bank giant Monzo suffered a shocking 40% devaluation, going from $2bn to $1.24bn, it looked like the worries were justified.

However, last week saw not one, but two companies bolster their unicorn status. UK-based remittance company TransferWise bagged a $319m in a funding round backed by D1 Capital, Vulcan Capital, Baillie Gifford, Fidelity Investments and LocalGlobe. The investment saw the FinTech reach a $5bn valuation, which is a 43% increase on its value in May 2019.

Fellow remittance company Remitly became the latest FinTech unicorn, having bagged an $84m investment to put its valuation at $1.5bn. The investment was backed by DN Capital, Generation Investment Management, Owl Rock Capital, Princeville, Stripes, Threshold Ventures and Top Tier.

Despite these funding rounds showing a strong interest into the payments and remittance sector, yearly funding could still be declining.

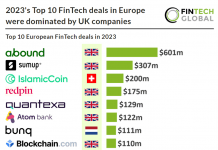

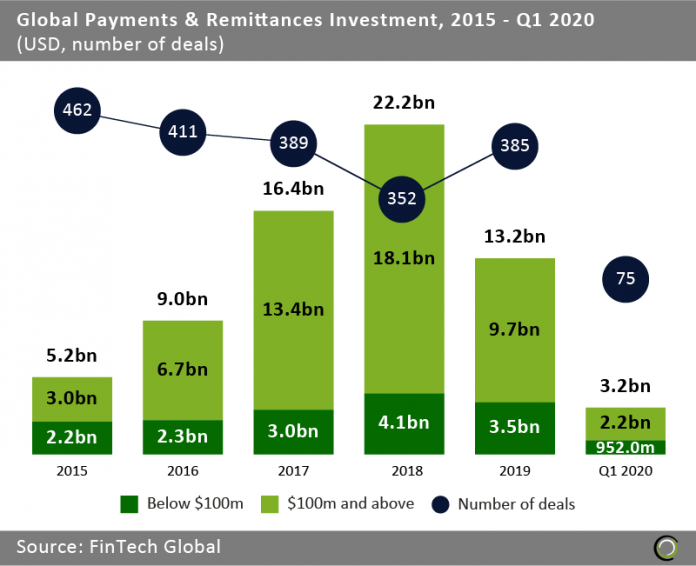

Since 2015, a total of $69.2bn has been invested into payments and remittance companies around the world, FinTech Global data shows. While there was still an immense $13.2bn was invested into the sector last year, it was a 40.8% drop from 2018 where $22.2bn was deployed throughout the year. This was despite a 10% increase in the number of deals completed.

Since 2015, a total of $69.2bn has been invested into payments and remittance companies around the world, FinTech Global data shows. While there was still an immense $13.2bn was invested into the sector last year, it was a 40.8% drop from 2018 where $22.2bn was deployed throughout the year. This was despite a 10% increase in the number of deals completed.

During the first quarter of 2020 there was a total of $3.2bn invested through 75 transactions, which is an 18.6% drop in investment volume and 19.3% decline in deal activity compared with the first quarter of 2019. With the impact of the coronavirus, it is unlikely funding will surpass last year, despite big deals like TransferWise and Remitly witnessed.

The payments sector is going through a massive shock at the moment following the Wirecard scandal. Wirecard collapsed in June after it revealed there was a $2.1bn hole in its finances. Since then there have been numerous updates and issues with authorities and regulators investigating what happened and how it did.

Last week had a number of new developments in the case. Bundesbank president Jens Weidmann called for German regulators to tighten the auditing and accounting rules to prevent another incident ever happening. Furthermore, German regulator BaFin is allegedly being sued by Wirecard investors for turning a blind eye to evidence things were wrong at the FinTech.

It seems Visa an Mastercard may also have known there were issues at Wirecard. A new report from the Wall Street Journal claims the pair of payment processors had each fined Wirecard an excess of $10m over a decade ago.

But not everything is about the payments and remittance space. There were 29 deals completed last year, across the entire FinTech space. Here is a roundup of them all.

TransferWise bags $5bn valuation on the back of $319m secondary share sale

UK-based money transfer platform TransferWise increased its valuation by 40% to reach $5bn, following the close of a $319m round. The round was backed by D1 Capital, Vulcan Capital, Baillie Gifford, Fidelity Investments and LocalGlobe. The FinTech recently received a license from the UK’s Financial Conduct Authority to offer savings and investment products, which it plans to launch later this year.

Thought Machine ups its Series B round to reach a sizeable $125m

Thought Machine, a cloud-based core banking technology developer, has netted an impressive $125m in its Series B. The company added $42m from Eurazeo Growth, British Patient Capital and SEB to the $83m it raised in the Series B earlier in the year. Backers to the previous tranche of funding include Draper Esprit, Lloyds Banking Group, IQ Capital, Backed, and Playfair Capital. Capital from the Series B is earmarked to support growth in the APAC region and hiring more staff to its newly opened office in Singapore.

Remitly bags $85m round at a $1.5bn valuation

Remitly, which provides remittances and financial services for immigrants, has bagged $85m in funding to help it enter the unicorn club. The company’s funding round put its valuation to $1.5bn. Funding was supplied by DN Capital, Generation Investment Management, Owl Rock Capital, Princeville, Stripes, Threshold Ventures and Top Tier. Funds will be used to continue its growth and meet customer needs.

401(k) platform Guideline bags $80m in its new funding round

Guideline, a 401(k) solution for small businesses, has closed an $80m in a funding round co-led by Generation Investment Management and Greyhound Capital. Previous Guideline backers Tiger Global Management, Felicis Ventures, Propel Venture Partners, Lerer Hippeau, Xfund, and BoxGroup also contributed to the round. With the capital injection, the company is planning to expand its partner ecosystem, integrate more service providers and offer more resources to participants.

ComplyAdvantage closes $50m Series C to fuel expansion drive

Financial crime fighting tech company ComplyAdvantage closed its Series C round on $50m, with Ontario Teachers’ Pension Plan Board, Index Ventures and Balderton Capital supplying the capital. With the fresh equity, the RegTech platform is hoping to expedite the development of its product and expand across the US, Europe and the Asia-Pacific region.

Financial platform aimed at the vulnerable True Link Financial bags Series B funding

True Link Financial, which provides vulnerable adults with safe financial products, has closed its Series B round on $35m. The capital injection was deployed by Khosla Ventures and Centana Growth Partners. Funds from the round will be used to help True Link increase the size of its team and explore new products in the insurance and credit markets.

Automated data discovery platform Explorium secures $31m Series B

Explorium, which empowers companies to create better predictive models by connecting internal datasets with external data sources, has collected $31m for its Series B. The lead investor was previous Explorium backer Zeev Ventures, with additional commitments coming from 01 Advisors, Dynamic Loop, Emerge and F2 Capital.

Circle closes $25m strategic investment from Digital Currency Group

Circle, which is a software company helping businesses to use stablecoins and public blockchains, has raised $25m in a strategic investment. The capital was supplied by Digital Currency Group (DCG) and will see Circle form a partnership with digital asset prime brokerage company Genesis, a subsidiary of DCG. The capital infusion will help Circle increase the adoption of its stablecoin USD Coin.

Health InsurTech startup Sidecar Health collects $20m in its funding round

Sidecar Health, an InsurTech helping consumers getting discounts by paying for care directly, has collected $20m in funding. The round was led by Cathay Innovation, with participation also coming from first time Sidecar Health backers Comcast Ventures, Kauffman Fellows and 23andMe co-founder and CEO Anne Wojcicki. Capital will be used to support Sidecar’s international growth initiatives and grow its team. The platform is available in 11 US states, but hope to enter more soon.

EMQ bags $20m in its Series B as it looks to increase its international presence

Global financial settlement network EMQ has bagged $20m in Series B preferred shares, which will help it with licensing activities in Asia, Europe and the Americas. WI Harper Group led the round, with Abu Dhabi Capital, AppWorks, DG Ventures, Hard Yaka, Intudo Ventures, January Capital, Quest Venture Partners, SparkLabs Taipei, Vectr Fintech Partners and VS Partners, also contributing. This fund infusion will help EMQ accelerate its international growth, bolster product development and increase licensing activities across Asia, Europe and the Americas.

Cryptocurrency platform Celsius Network scores $18.8m in its new funding round

Celsius Network, an interest-earning platform for cryptocurrency, has scored $18.8m in its new funding round. Contributions to the round came from both qualified US and non-US investors via the investing platform BnkToTheFuture.

Mediant bags $18.5m in equity infusion

Mediant designs communication technology for banks, brokers, corporations and funds. The FinTech has closed an $18.5m investment, which was led by New York-based growth equity investor Argentum. Other backers include Breakwater Mediant, Compo Seven Capital, Mathers Associates and First Analysis Corporation.

Cloud security company Ermetic raises $17.25m in its Series A round

Cloud access risk security startup Ermetic has raised $17.25m in its Series A round to support its go-to-market efforts. Investors of the round include Glilot Capital Partners, Norwest Venture Partners and Target Global. The RegTech is using this capital to enhance its research and development, go-to-market, sales, marketing and customer support initiatives.

Robo-advisor StashAway bags $16m for its Series C

Singapore-based robo-advisor StashAway has collected SGD $22.3m ($16m) in its Series C round to help it enhance its product suite. Square Peg acted as the lead investor, with other backers including Burda Principal Investments, the investment division of German media and tech company Hubert Burda Media, and global investor Eight Roads Ventures.

Cybersecurity training platform RangeForce scores $16m in its Series A funding round

RangeForce, a cloud-based platform aimed at training employees on cyber threats, has closed its Series A round on $16m. RangeForce led the round, with commitments also coming from Trind and Cisco Investments. The cybersecurity company is using the capital to bolster its go-to-market efforts, advance product development, expand its training orchestration partner base and boost its global presence.

Accounting software CANDIS collects €12m in its latest funding round

Automated accounting and payment processing platform CANDIS has collected €12m in a funding round, which will help it expand across Europe. Lead investors for the round were Viola Ventures and Rabo Frontier Ventures, with contributions also coming from previous backers Lightspeed Venture Partners, Point Nine Capital, Speedinvest and 42CAP. The extra cash will help the development of its machine learning engine, fuel its growth and continue its European expansion.

Cybersecurity company Whistic bags $12m in its Series A round

Whistic, which is helping buyers and sellers to establish trusted relationships, has netted $12m for its Series A. Emergence led the round, with contributions also coming from Album VC and unnamed existing investors. The equity is helping the cybersecurity company expand its operations and hire more staff.

Brazil’s Magnetis said to raise $11m as it looks to become a full-service brokerage

Magnetis, a wealth management solution for Brazilian investors, has reportedly raked in $11m for its new funding round. Investors to the round include Redpoint eventures and Vostok Emerging Finance. Magnetis is using the capital to launch its own brokerage service and build new features that will improve the customer experience.

Life insurance firm Covr Financial bags $7.5m in its new funding round

Covr Financial Technologies, which offers a portfolio of life insurance services for banks, credit unions and advisers, has secured a $7.5m investment. Connecticut Innovations, Fairview Capital and Aflac Ventures supported the round. This investment will help Covr to bring more products to market.

CyberTech100 company Mitiga said to raise $7m in its seed round

Cloud incident readiness and response software solution Mitiga has reportedly bagged $7m in its seed round. The Israel-based company received the funding from Clearsky Security, Glilot Capital, Flint Capital, Rain Capital and DNX Ventures.

India-based Jodo said to close its seed round

Jodo, which helps families pay for higher-education, has bagged RS 28.5 crore ($3.8m) in seed funding. The round was backed by Matrix Venture Partners, SAIF Partners and a group of 15 angel investors.

Spyderbat raises $2.4m in funding as it preps for launch

Cybersecurity platform Spyderbat has raised $2.4m in its seed funding round, which was led by LiveOak Venture Partners and Benhamou Global Ventures. Other investors to the startup included cybersecurity veteran John McHale. This equity burst will enable Spyderbat to accelerate the development of its product, which will be launched later this year.

Soon to launch Wingocard closes $2m seed round to support its development

Personal finance mobile app targeting teens Wingocard has scored $2m in its seed round, which was led by Diagram. The platform is earmarked for an Autumn launch and there are already 50,000 new users on the waiting list. Teens can use the app to improve their understandings of earnings, spending and savings habits.

Ireland’s CreditLogic said to raise €1.5m in its seed round

CreditLogic has reportedly bagged €1.5m in its seed round from an unnamed backer. The company, which offers an AI-powered tool to streamline the loan application process, recently released its Virtual Assistance feature to help advisers and consumers communicate in real-time. With the equity, the company plans to accelerate its product roadmap and improve its loan origination services.

SignD closes €1m investment to bolster international growth efforts

Austrian RegTech platform SignD Identity has closed a €1m investment which will help it to bolster its international sales and marketing efforts. The round was several of angel investors including QC Advisers founder Fritz Schweiger, former Jumio investor Felix Famira and others. The digital onboarding and KYC software developer plans to release its Qualified Electronic Signature service later in the year.

Crypto trading platform AltFINS said to raise €1m in funding

Cryptocurrency trading management platform AltFINS is another FinTech to close a seed round this week, having collected €1m. Slovakia-based CB Investment Management was the lead investor, however, other contributors not being disclosed. The funding round is planned for expanding AltFINS technology capabilities and boosting the scalability of its offering.

Estonia’s Montonio reportedly raises €500,000 in pre-seed funding

Point-of-sale financing solution Montonio has allegedly raised €500,000 in pre-seed funding. Contributions to the round came from Gorilla Capital, Practica Capital, Superangel, Katana Capital founder Charlie Songhurst, former TransferWise COO Triin Hertmann. and former TransferWise head of product Martin Sokk and Bolt CPO Jevgeni Kabanov, according to a report from EU-Startups.

Pickright Technologies said to raise RS 1 crore ($133,000) in funding

Pickright Technologies, an India-based company helping to connect retail investors with stock market advisers, has reportedly raised RS 1 crore ($133,000) in a round. The investment was supported by unnamed angel investors from India, the UK and Singapore. Having closed the round, the company will increase the product development, increase marketing efforts and strengthen its brand.

Deutsche Bank makes strategic investment into Traxpay

German financial institution Deutsche Bank AG has made an undisclosed investment into German FinTech startup Traxpay. The deal will see Deutsche Bank leverage Traxpay’s technology to access discounting and reverse factoring to better manage cash flow flexibility.

Copyright © 2020 FinTech Global