Cybersecurity has had a big funding week with ReliaQuest picking up the biggest round last week, but several challenger banks and InsurTech ventures also bagged considerable cash injections.

Last week, FinTech Global reported on 25 funding rounds completed by FinTech businesses from around the globe. Looking closer at them, it’s clear that there are some subsectors in the industry to keep a closer eye on: cybersecurity, InsurTech and challenger banks.

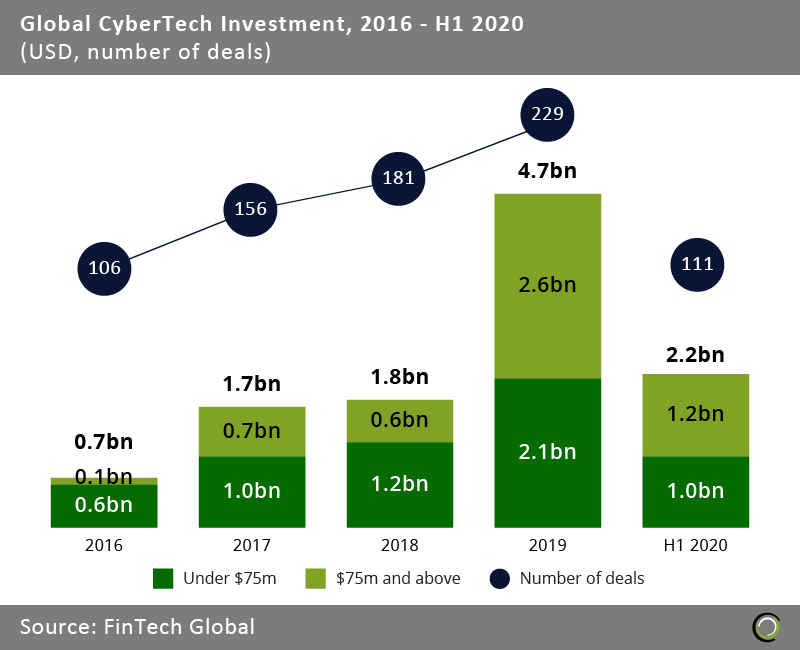

The cybersecurity sector had a huge win last week, with ReliaQuest securing the biggest funding round of the week by adding an additional $300m to its war chest. The investment comes on the back of industry experts having said that the Covid-19 crisis would be good for the cybersecurity sector as more cyber criminals have tried to leverage the pandemic to launch different types hack attacks.

“The unprecedented shift to remote working from March resulted in strong demand for endpoint security to protect new company-deployed notebooks, as well as consumer-owned devices used as part of business continuity measures,” said Matthew Ball, chief analyst at Canalys.

However, Canalys’ recent research also predicted that the cybersecurity boom wouldn’t last once top executives started holding onto their purse strings a bit tighter to enable them to ride out the global health crisis.

FinTech Global’s own research shows that investment into the sector slowed down by roughly 60% in the second quarter of 2020. In total, the cybertech sector raised $2.2bn in the first six months of the year.  The InsurTech industry has enjoyed similar predictions from several sector stakeholders predicting that the coronavirus could lead to an upswing in InsurTech investment. This last week saw InsurTech ventures like Eden Health, Breathe Life, Wrapbook and Zensurance all raise big rounds.

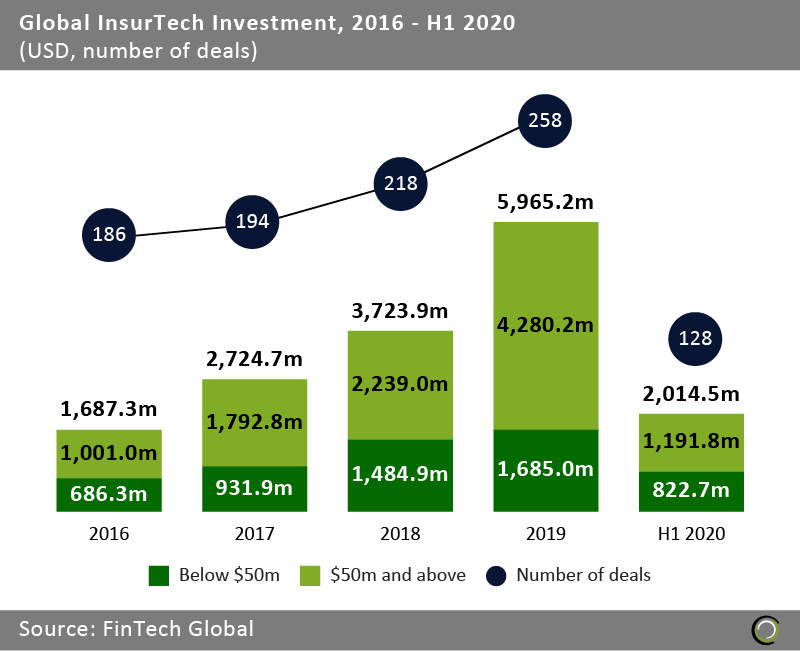

The InsurTech industry has enjoyed similar predictions from several sector stakeholders predicting that the coronavirus could lead to an upswing in InsurTech investment. This last week saw InsurTech ventures like Eden Health, Breathe Life, Wrapbook and Zensurance all raise big rounds.

But the again the stats seem to paint a different picture. Total InsurTech funding between January and June saw a 13.3% drop compared to the same period in 2019, according to FinTech Global’s research. Despite the drop, there was a 5.4% increase in the number of deals compared to the same period last year.

Investment into the InsurTech industry grew from $1.68bn in 2016 to $5.96bn in 2019. By the end of June 2020, the industry had only raised $2.01bn in total.

The last week saw the challenger banks Fondeadora and Copper Banking both raise early-stage investment rounds. There are two sides of this segment of the industry to consider.

The last week saw the challenger banks Fondeadora and Copper Banking both raise early-stage investment rounds. There are two sides of this segment of the industry to consider.

Firstly, the sector has gone from strength to strenght in recent years, having established several big names such as Revolut, Nubank and Chime. In fact, some researcher estimate that the global neobank market will grow from being worth $20.4bn in 2019 to reach a value of $471bn by 2027.

But secondly, you can flip that around and look at the more recent trends in the sector. In the UK, the three leading neobanks – Revolut, Monzo and Starling Bank – have all reported gigantic losses over the last year.

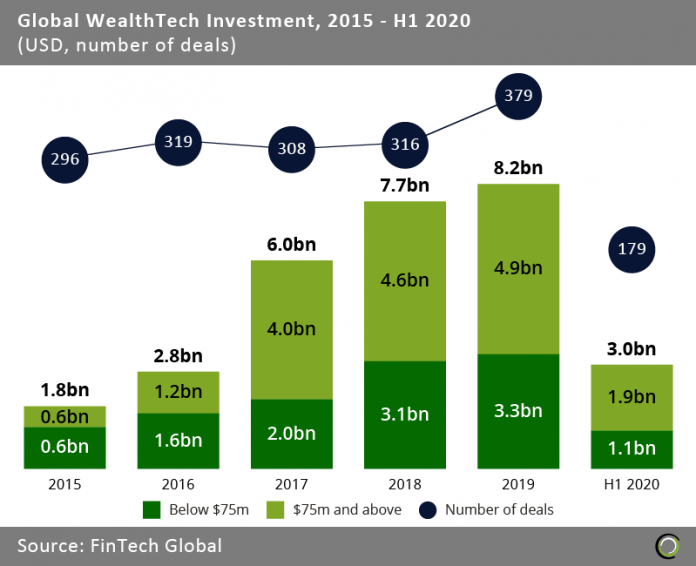

Moreover, while six digital banking companies were among the ten biggest WealthTech deals in the first half of 2020, the WealthTech sector as a whole is enroute for its worst year of funding since 2017. So far, the sector has only raised $3bn in 2020. That’s a huge drop from the $7.7bn and $8.2bn rasied in 2018 and 2019 respectively, according to FinTech Global’s research.

So, let’s take a closer look at the 25 rounds we reported on in the last week of August.

ReliaQuest secured a massive $300m investment

Cybersecurity venture ReliaQuest has collected $300m in a funding round led by private equity giant KKR and additional investments from Ten Eleven Ventures and ReliaQuest founder and CEO Brian Murphey. ReliaQuest will use the money to fund the acceleration of its growth, including its global expansion and further developments of its flagship platform GreyMatter. GreyMatter is a cloud-native SaaS platform that consolidates, normalises and correlates date from customers’ current cybersecurity solutions. The cybersecurity company raised a $30m growth equity injection from FTV Capital back in 2016.

Gong nets $200m in Series D round

Revenue intelligence platform Gong has secured $200m in its Series D funding round, which brings its valuation to $2.2bn. Coatue led the raise. Gong also enjoyed cash injections from Index Ventures, Salesforce Ventures and Thrive Capital. A number of existing Gong backers also joined the round, including Battery Ventures, NextWorld Capital, Norwest Venture Partners, Sequoia Capital and Wing Venture Capital. The venture will used the money to support the market demand for its platform and bolster its product, engineering and go-to-market teams.

Redis Labs nets $100m in Series F funding round and joins unicorn club

Anti-fraud fighting FinTech Redis Lab has joined the coveted unicorn club after securing $100m in fresh capital on the back of Series F round co-led by Bain Capital Ventures and TCV.Francisco Partners, Goldman Sachs Growth, Viola Ventures and Dell Technologies Capital also contributing to the raise.

Redis is a real-time data platform that empowers teams to manage, process, analyse and make predictions to improve customer experiences. Its use cases include fraud prevention, claims processing, session management, real-time inventory, messaging and more.

Financial services are using the platform to improve their digitalisation whether that is through offering customers personalised interactions or improving the detection and response of fraudulent activity.

Socure secures $35m in new funding

As we reported last week, identity verification platform Socure has added $35m to bolster its for its latest equity round, which will enable it to improve its technology stack. The capital infusion was led by Sorenson Ventures, with contributions also coming from previous Socure backers Commerce Ventures, Scale Venture Partners and Flint Capital.

A handful of new strategic investors also joined the round, including Citi Ventures, Wells Fargo Strategic Capital and MVB Financial Corp.

Form3 scores $33m in new funding

Payment technology company Form3 has netted $33m in funding to fuel its further expansion plans and the development of its technology. Lloyds Banking Group, Nationwide Building Society, 83North and Draper Esprit joined the round.

Finix adds $30m to its Series B round

Payment FinTech Finix was revealed to have extended its Series B round last week. Having added $30m to the round, it has now brought the total invested in the raise to $75m. Lightspeed Venture Partners and American Express Ventures injected the fresh capital.

AffirmLogic closes $25m round

Cybersecurity company AffirmLogic has bagged $25m in a new funding round led by an anonymous group focused on tech companies. AffirmLogic helps firms lower their cyber risk by applying behaviour computation to a range of scenarios. Its technology leverages mathematical behavioural computation to detect, analyse and defend against malware attacks.

Eden Health nets $25m for its Series B round

Heathcare and insurance company Eden Health has bagged $25m in its Series B round, which was led by Flare Capital Partners. Other contributions came from private equity firm Stone Point Capital and previous Eden backers Greycroft, PJC, Max Ventures and Aspect Ventures. This investment brings the company’s total funding to $39m.

Mexican neobank Fondeadora bags $14m Series A round

Having launched in 2018, Mexican challenger bank Fondeadora already manages 150,000 accounts. Now it has collected $14m in a Series A round led by Gradient Ventures. It also enjoyed the backing of Y Combinator, Sound Ventures, Fintech Collective and Inga.

Avail Finance bags $11.5m in Series B round

Bengaluru-based FinTech startup Avail Finance has raised roughly $11.5m in a Series B investment to bolster its lending services. It raised the funds from lead investor Alphawave Incubation Fund and Matrix Partners.

InsurTech Breathe Life collects $11.5m in new raise

End-to-end life insurance solution provider Breathe Life has received $11.5m in a funding round comprised of equity funding, debt financing and a grant. Of the fresh capital, the InsurTech raised $6.5m in Series A funding from Real Ventures, Investissement Québec, Clocktower Technology Ventures, Cameron Ventures, Desjardins, NAventures, and Diagram Ventures. Real Ventures & Investissement Québec acted as the co-lead investors.

Music funding company Stem bagged $10m

Distribution and payments platform Stem filled its coffers last week to the tune of $10m in a funding round led by Slow Ventures. Aspect Ventures and Upfront Ventures also contributed to the raise. The startup enables clients to deposit music on its platform which can be distributed and monetise it through Apple Music, Spotify and Google Play Music.

Berbix secures $9m in a Series A round led by Mayfield

Last week we reported that digital identity startup Berbix had closed a Series A round on $9m. The round was led by Mayfield, with contributions also coming from Initialized Capital, Y Combinator and Fika Ventures. Berbix will use the money increase its team size and bolster customer growth.

Stratify closes $4.9m seed round led by Madrona Venture Group

Real time analytics and collaborative budgeting FinTech Stratify has closed a $4.9m seed round. The funding was led by Madrona Venture Group, with support also coming from Coatue.

Copper Banking adds $4.3m of investment to its coffers

Teen-focused digital bank Copper Banking netted $4.3m in its seed round. PSL Ventures led the raise, which also enjoyed additional funding from Snap director of product Jack Brody and Western Technology Investment.

Wrapbook scores $3.6m in its seed round led by Equal Ventures

InsurTech Wrapbook has bagged $3.6m in a seed round of funding round led by Equal Ventures, a US-based seed-stage investor. Wrapbook has created a solution that automates payroll fillings and tax payments, with it capable of calculating both federal and local taxes across the whole of the US. Its technology also calculates employer fringes and timecards, as well as collecting union pension and health benefits.

Blacksoil Capital collected $3.4m in fresh capital

Last week we reported that credit platform Blacksoil Capital had added $3.4m to its accounts with the help of more than 60 investors. Blacksoil Capital has previously specialised in venture, structured and real estate debt but has has pivoted its focus because of the coronavirus pandemic, meaning it will back healthcare and edtech ventures.

Open Payments secures €3m in seed funding round

While Klarna may have been been the Swedish FinTech company that grabbed the most headlines after announcing a sevenfold increase in its losses in the first half of 2020, last week also saw Open Payments secure €3m in a seed round. The company said it would use the money to fund its expansion plans across the Nordics and in the EU. The money was raised by Swedish investor Industrifonden.

“Open Payments platform makes it easy for companies to take advantage of the enormous business development potential that open banking entails for small and large companies,” said Anna Ljungdahl, investment manager at Industrifonden.

IMMO Investment Technologies adds €3m to its Series A

IMMO Investment Technologies has reportedly netted an additional €3m for its Series A round, which initially closed on $11m. This fresh Series A capital was supplied by FinTech Collective and Surplus Invest, according to a report from Property Funds World.

Esusu extends seed round with another $2.3m

Credit scoring FinTech Esusu has extended its seed round with another $2.3m, bringing the total raised in the round to $4m. The company originally closed its round in August 2019. The FinTech’s latest fundraise was backed by investors including Acumen Fund, Concrete Rose Capital, Global Good Fund, Impact America Fund, Next Play Ventures and Zeal Capital Partners.

Billon nets £2m in funding from the UK Future Fund

The London and Warsaw-based FinTech Billon has topped up its accounts with a £2m cash injection supported by the Future Fund scheme, which matched the £1m invested by angel investors and VCs. Billon is a developer behind a DLT protocol and system specifically for tokenising and transacting national currency and processing sensitive data in compliance with regulations.

Artis Technologies bags $1.5m

Artis Technologies, an API solution developer, has closed its seed round on $1.5m, but is looking to raise more capital later in the year. The capital was supplied by Fintech Ventures Fund and its affiliates and marks the company’s first institutional investment.

Thirdfort nets £1m in seed-plus funding round

LegalTech startup Thirdfort has raised £1m from investors including the founders of Funding Circle to speed up its growth. The investors backing the raise included James Meekings and Andy Mullinger, co-founders of Funding Circle, Mishcon de Reya, and David Rutter, founder of R3.

Visa invests in MagicCube

MagicCube, which claims to have the world’s only software trusted execution environment platform, has secured a strategic investment from Visa. This is an extension of an existing partnership with Visa. Earlier in the year, Visa was among the investors of a funding round for MagicCube, which also attracted support from Azure Capital, Bold Capital, Epic Ventures and NTT Data.

Zensurance closes Series B round

Canadian digital commercial insurance platform Zensurance has closed its Series B round to increase its hiring efforts. The round was supplied by global insurance company The Travelers Companies. Capital from the round will be used to scale the hiring efforts and increase its customer base to over 150,000 Canadian small businesses.

Copyright © 2020 FinTech Global