Despite Covid-19 and Brexit, challenger bank OakNorth claims to have been able to avoid many of the hurdles other neobanks have faced.

2020 has proven a tricky year for challenger banks. Three of the leading digital banks in the UK – Starling Bank, Revolut and Monzo – have all reported that their losses have doubled in the last year, raising concern about how much trouble the UK challenger scene is really in. In Germany, N26 is embroiled in a stand-off with its workers. The coronavirus and the upcoming break between the EU and the UK is not helping matters either. N26 has already said its abandoning the British Isles because of Brexit and Dutch neobank bunq has warned that other FinTechs may follow.

However, British OakNorth is claiming to have successfully avoided these pitfalls so far. “It’s still the early days of the crisis and because of the government’s stimulus packages, we have yet to feel the full effects of the pandemic or Brexit which will happen by the end of the year,” James Cashmore, chief risk officer at OakNorth Bank, tells FinTech Global. “That said, we’ve managed to turn this crisis into an opportunity and have continued to lend and support strong management teams and viable British businesses during this difficult time.”

Part of his bullishness is due to actions taken back in January when the health crisis started to emerge. One of those was to take a closer look at potential supply chain disruptions. “As part of this, we reviewed our entire loan book and came up with a Covid vulnerability rating (CVR) framework that analyses the impact on businesses as a result of an extended lockdown,” Cashmore explains. “In tandem, we’ve also approved circa £1bn in new loans including [around] £385m via the Coronavirus Business Interruption Loan Scheme (CBILS) and the Coronavirus Large Business Interruption Loan Scheme (CLBILS).”

That doesn’t mean that OakNorth hasn’t faced its fair share of challenges. The pandemic has upped the demand for faster digital services, meaning more pressure has been put on the business-focused digital lender’s compliance infrastructure.

“[The] challenge was being able to complete our normal due diligence processes, without in any way compromising our standards, for a large volume of new loans in a short space of time,” says Cashmore. “We responded by delivering £1.4bn of new facilities in seven months and were able to achieve that through our continued investment. Because the bank is on a rapid growth trajectory, we had invested in Q4 last year and Q1 this year ahead of the crisis in additional skilled people and new systems for searches and due diligence, and that investment delivered results in terms of customer service.”

As part of its drive to boost its compliance efforts, OakNorth has now inked a deal with ComplyAdvantage, the company developing financial crime-fighting technology. The partnership will equip OakNorth with an improved customer-onboarding experience, which is said to be fully compliant with anti-money laundering regulations.

Tapping into ComplyAdvantage’s suite of financial crime detection tools will also empower OakNorth to more efficiently screen for risk during the onboarding process and to monitor entities in real-time throughout the customer lifecycle, including their transaction activity and any adverse media connected to them.

“OakNorth Bank needed a solution that was fundamentally different than anything on the market,” says Vatsa Narasimha, COO of ComplyAdvantage. “With ComplyAdvantage, OakNorth Bank has a trusted data and financial risk management technology partner that will be able to support them as they scale further. We are proud of the solution we have today and are excited to partner with one of the top digital banks in the world.”

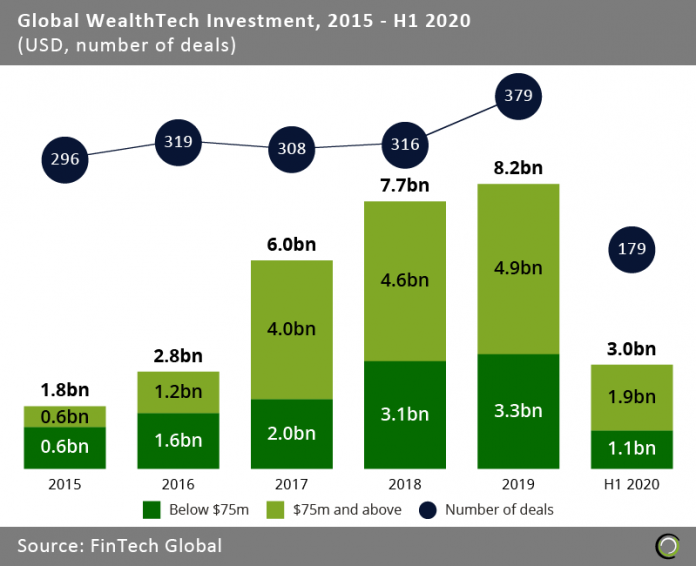

It is not just challenger banks that are having problems due to Covid-19. As we have reported in the past, the WealthTech sector is seemingly heading towards its worst year in years, in terms of investment.

Between 2015 and 2019, the amount of investment injected into the global WealthTech industry jumped from $1.8bn to $8.2bn, according to FinTech Global’s research. Yet, the sector only raised $3bn in total in the first six months of 2020. This would put the WealthTech industry on course for its worst year since 2017 when the industry raised $6bn in total.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global