Last week week saw 28 FinTechs close investment deals. Three sectors in particular proved especially successful.

It’s been a busy week for FinTech entrepreneurs around the world. However, while challenger banks like Monzo and Step, several RegTech and InsurTech companies and a smattering of WealthTech enterprises all raised significant sums in the last seven days, three sectors that saw ventures secure additional funding proved particularly interesting to us.

Businesses in the payment, banking infrastructure and buy now pay later (BNPL) sectors successfully topped up their coffers last week. Each of these industries have seen significant growth and action recently, which is why the rounds raised caught our eye.

Let’s start with the payment industry. Two payment companies secured the biggest funding deals last week: India-based PhonePe and Saudi Arabia-based STC Pay, which secured $700m and $200m respectively.

These rounds show that the payment industry is still very much alive. This point is strengthened by the news that UK challenger bank Revolut is now essentially declaring war on industry giants Adyen and Stripe by launching its own business payment processing service.

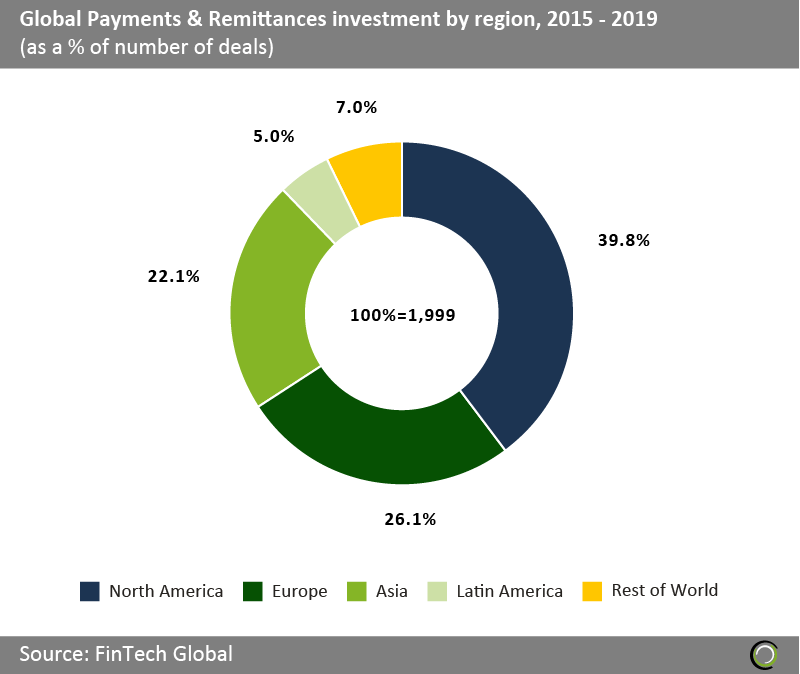

So where is the action at? Looking at the regional divide of the payment industry it is clear that North America has long been the leader when it comes to cash raised. It raised 39.8% of the funding into the payment sector between 2015 and 2019, according to FinTech Global’s research. In the same period, Europe raised 26.1% whilst Asian payment companies picked up 22.1% of the total global investment.

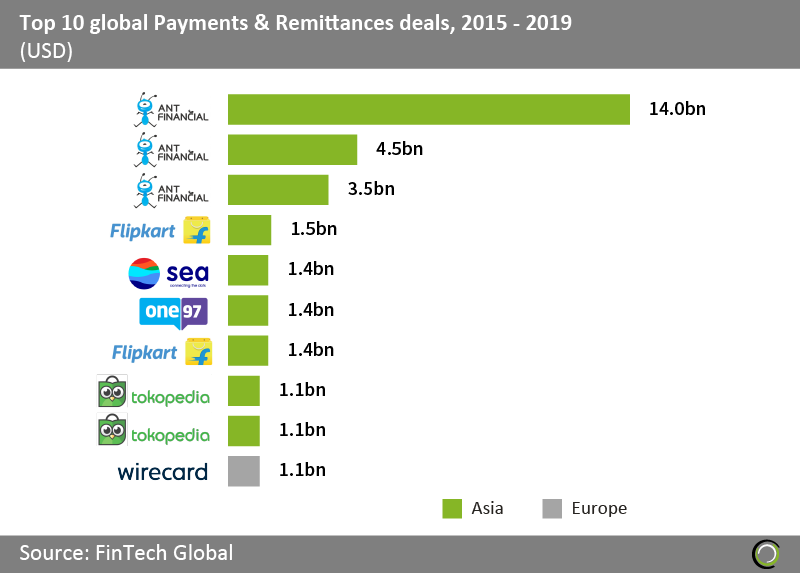

Although, in that period, Asian companies were behind nine out of the ten top deals. Chinese Ant Financial was behind three and Flipkart two. The only company that wasn’t from the region and still managed to claim a spot on the top ten deal list was Wirecard, which imploded this summer after allegations of a global billion dollar fraud were levied against the company and its leadership.

Although, in that period, Asian companies were behind nine out of the ten top deals. Chinese Ant Financial was behind three and Flipkart two. The only company that wasn’t from the region and still managed to claim a spot on the top ten deal list was Wirecard, which imploded this summer after allegations of a global billion dollar fraud were levied against the company and its leadership.

Now, let’s talk about banking. With a deluge of neobanks having hit the market, it may be easy to forget that traditional lenders are still very much alive and, if not well, then at least still currently in business.

Now, let’s talk about banking. With a deluge of neobanks having hit the market, it may be easy to forget that traditional lenders are still very much alive and, if not well, then at least still currently in business.

And they are making efforts to stay that way, which is why the third biggest deal last week closed by Amount is so interesting. The venture, which secured $81m in a Series C round, is developing solutions to help banks digitalise their services in order to meet the competition from challenger banks and other FinTech upstarts.

Although, Amount is not the only company to offer a core banking software solution. Many startups around the world are actively offering services to help banks upgrade their infrastructure. In fact, the market is expected to grow at a compound annual growth rate of 7.5% in the next seven years, putting its value at $16.38bn by 2027.

However, their modernising efforts have had adverse effects on their workforce. Banks like Deutsche Bank, HSBC and Commerzbank have all been forced to make massive redundancies as employees are being replaced by digital solutions.

The third round that proved particularly eye-catching to us last week was LimePay. While the BNPL startup’s $21m pre-IPO round was only the seventh biggest raise last week, it fits in with a current trend we’re seeing where the sector is heating up.

For starters, Klarna became Europe’s most valuable privately owned FinTech company in September after raising a $650m funding round that saw its valuation skyrocket to $10.65bn. Following the raise, reports have flourished about the Swedish decacorn’s efforts to go public in the not too distant future. Last week saw it name Sequoia Capital’s Michael Moritz as Klarna’s new chairman in a move analysts believed was another indication that a public listing is very much in the books.

At the same time, Klarna has been engaged in a war of words with its Australian competitor Afterpay. Klarna has accused Afterpay of using extortionate rates for merchants to which the Australian FinTech responded by saying that if things were so bad, why are more merchants choosing Afterpay outside of Europe.

Add to that that payments giant PayPal, small business lender iwoca, UK startup Zilch and Danish neobank Lunar have all launched similar instalment products of their own and it is clear that the competition in the BNPL space is only going to get tougher.

Now, here are the 28 rounds we reported on in the last week.

PhonePe partially spins out of Flipkart and raises $700m

India-based PhonePe has raised $700m in a round led by Walmart and supported by prior investors as it announced that it would partially spin out from e-commerce giant Flipkart. PhonePe’s valuation now sits comfortably at $5.5bn at the close of the new round. Flipkart had acquired the Bangalore-based FinTech in 2016 and the new partial spinout will reduce its ownership from 100% to 87%.

“This partial spin-off gives PhonePe access to dedicated long-term capital to pursue our vision of providing financial inclusion to a billion Indians,” said Sameer Nigam, founder and chief executive of PhonePe, in a statement.

STC Pay secures $200m investment

Saudi Arabia-based STC Pay, digital payment solution developer, has reportedly reached a $1.3bn valuation after the close of a $200m investment.

Western Union invested the $200m in exchange for a 15% stake in the payments company. The close of the round makes STC Pay the first unicorn in Saudi Arabia and the first FinTech unicorn in the Middle East, it said. With this capital injection, STC plans to expand its financial offerings across the Gulf region.

Amount secures $81m Series C investment

Technology provider for financial institutions Amount has added $81m to its coffers in a Series C investment round led by Goldman Sachs Growth. Existing investors, including August Capital, Invus Opportunities and Hanaco Ventures, also participated in the raise. The company will use the money to keep helping banks and other financial institutions to modernise their digital offering.

Monzo secures another £60m investment round

UK challenger bank Monzo has raised another £60m at a $1.2bn valuation just months after raising a similar amount at the same valuation. The new round was backed by Deliveroo and Stripe investor Novator, Kaiser, and TED Global, as well as existing investor Goodwater who joined Y Combinator, General Catalyst, Accel, Passion, Thrive and Stripe, who all re-invested earlier this year.

This brings the total injected into Monzo to £125m since the coronavirus crisis broke out. The last £5m were reportedly added as a top up to the £60m round recorded this summer.

The round this summer saw the neobank’s valuation plummet by 40% from the $2bn valuation recorded a year earlier when it raised a £113m round.

Celebrities line up to back Step’s $50m Series B round

Several celebrities, including Justin Timberlake, are among the investors behind teen banking app Step’s new $50m Series B round. Other celebrities backing the venture include Charli D’Amelio, Eli Manning, The Chainsmokers, Kelvin Beachum, Larry Fitzgerald and Andre Iduodala. Coatue Management led the round, which also saw participation from Stripe, Will Smith’s Dreamers VC, CrossLink Capital and Collaborative Fund. Step is set up to enable parents to view their children’s balances and real-time spending as well as empowering them lock the kids out of their accounts if need be.

GoSecure extends its Series E round to reach $35m

Managed detection and response platform GoSecure has closed its oversubscribed Series E round on $35m. The round was led by Montreal-based investor W Investments Group, with additional contributions coming from Yaletown Partners. This is an extension to the previously closed Series E round back in June, where the RegTech pulled in $20m. The capital was supplied by Yaletown Partners, Bank of Montreal, SAP/NS2 and Razor’s Edge.

LimePay bags $21m in a pre-IPO round

Buy now, pay later service provider LimePay has reportedly bagged $21m in a pre-IPO funding round. The equity line was supplied by unnamed high net worth institutional investors. LimePay is exploring yet another batch of funding in early 2021, it said. Based in Australia, the FinTech company enables merchants to offer customer the ability to spread the payments for an item over a number of monthly instalments. Customers are able to decide how much they wish to pay each month and the frequency of instalments.

EclecticIQ bags $20m in its Series C

Global threat intelligence, hunting and response technology developer EclecticIQ has scored €20m in its Series C round. Ace Management acted as the lead investor, with additional support coming from Capricorn Digital Growth Fund, Quest for Growth, Invest-NL and Arches Capital. Several existing EclecticIQ backers also joined the round, including INKEF Capital, KEEN Venture Partners and KPN ventures.

Glasswall closes £18m funding round

UK-based cybersecurity company Glasswall has completed an £18m funding round to support its ongoing expansion. The investment was led by IPGL, with participation also coming from Ocado chairman Lord Rose, IHS Markit chairman and CEO Lance Uggla and AJ Bell founder and CEO Andy Bell. IPGL, which first backed the RegTech in 2018, supplied £9.5m to the round and now holds a 44% stake in the business. This equity injection will be used to support the next stage of the cybersecurity’s growth, which includes product development, boosted engineering, and increased sales and marketing.

Updraft seals £16m equity and debt investment

Lending, credit monitoring and financial planning app Updraft has scored a £16m equity and debt funding round. Updraft, which has launched onto the Apple App Store, aims to prevent consumers drifting into borrowing more and more each month without noticing. It estimates that consumers will pay over £10bn in fees and interests for overdraft and credit cards in 2020 alone. The UK government’s Future Fund is providing equity in the form of convertible loan notes, while specialist investor Quilam Capital is leading on the debt side.

Pave secures $16m in a Series A round

Real-time total compensation tools provider Pave has secured $16m in its Series A funding round. Andreessen Horowitz led the raise via its a16z Cultural Leadership Fund. Bessemer Venture Partners, Jeff Bezos’ personal investment company Bezos Expeditions, Dash Fund, and Y Combinator also participated in the oversubscribed round. Pave was previously known as Trove, but rebranded alongside the investment announcement.

Pockit bags £15m in Series B round partially raised on Crowdcube

UK-based FinTech startup Pockit has netted £15m in a new Series B round, partially via a Crowdcube raise. The crowdfunding campaign represented £500,000 of the investment and the rest were supplemented by money form existing and new investors.

Primer closes £14m funding round

Primer, a low-code payments infrastructure and online checkout API, has scored £14m in its Series A funding round, led by Accel. Other participants to the round included Balderton, SpeedInvest, Seedcamp and RTP Global. Capital from the round will be used to enhance the company’s business development efforts, increase international expansion and enhance its product capabilities. The company, which was founded earlier in 2020, the company provides e-commerce merchants and online payments facilitators to connect and maintain their entire payments ecosystem via a unified payments API and checkout.

Bitwala closes €13m Series A round

Blockchain-based bank account Bitwala has reportedly secured €13m in its Series A round, which was led by Earlybird Capital. The investment was also supported by Coparion and Global Bain. This capital infusion will enable Bitwala to onboard more customers and release new features for its platform.

Deduce raises $7.3m in seed capital

Deduce, a collective intelligence platform helping to combat account takeover and fraud, has reportedly collected $7.3m in its seed round. True Ventures acted as lead investor, with contributions also coming from Ridge Ventures. A handful of angels investors also contributed to the round, including ISS founder Tom Noonan and former Neustar CEO Lisa Hook. Deduce leverages collective intelligence to democratise cybersecurity through developer-friendly tools that combat account takeover and fraud. Its platform is powered by 150,000 websites, to create a diverse identity data network.

Mintos secures €7.1m in new investment

Alternative investment app Mintos has smashed the target for its crowdfunding campaign, raising more than seven-times the original goal. The FinTech, which raised the capital on Crowdcube, bagged €7.1m at a pre-money valuation of €68m. Mintos originally hoped to raise just €1m when it launched the crowdfunding.

Fisdom has closed a $7m funding round led by PayU

WealthTech startup Fisdom has bagged $7m in an investment round led by payment technology firm PayU. PayU had previously bought a minority stake in Fisdom for $5m. Existing investors Quona Capital and Saama Capital also participated in the raise.

AgentSync secures $6.7m seed extension

InsurTech AgentSync has secured $6.7m in a new funding round led by Craft Ventures. The company, which offers a compliance platform for the insurance space, was also backed by Operator Collective and prior investors, according to TechCrunch. The InsurTech business will use the money to strengthen its talent pool with additional hires.

Floww nets $6.7m in seed funding

Data-driven investor marketplace Floww has raised $6.7m in a seed funding round led by angel investors and friends. The company connects potential investors with startups based on merit, clean data and transparency, aiming to replace old school introductions that may be weighted down with both racial and cultural bias.

Ziglu scores £6m on Seedrs

Personal money app Ziglu has scored £6m in an oversubscribed crowdfunding round, which pulled in more than five-times its original target. The campaign, which is allegedly the largest equity raise on Seedrs in 2020, received contributions from more than 1,250 investors. The average investment amount was £4,800. Ziglu managed to reach its initial £1m target in just three hours of the campaign launch.

FloatMe has bags almost $3.7m in funding

San Antonio-based Floatme has netted $3.7m in equity financing. The startup, founded in 2017, is designed to help people make better financial decision. The investments include $896,000, according to documents filed at the Securities and Exchange Commission.

Signzy has secured $3m in new funding

India-based Signzy has added another $3m to its coffers just months after the startup raised $5.4m in a previous round. The tech venture the closed the previous round in October this year. Vertex Ventures led the round, which also saw participation from existing investors Kalaari Capital and Stellaris Venture Partners. The money will reportedly be used to keep developing Signzy’s artificial intelligence-powered platform and to scale its global sales team.

Pomelo Pay scores £2.1m in funding

Digital payments startup Pomelo Pay has bagged £2.1m in its seed funding round, which was led by Force Over Mass. Capital from the round will help Pomelo to deepen its platform and better help businesses navigate the current market. Pomelo will also use the funds to expand its growing team and expand its international reach across Europe and Asia.

Vauban closes £1.6m seed round

Vauban, which enables investors to build funds and investment vehicles online, has reportedly closed its seed round on £1.6m. The capital was supplied by VC Pi Labs, Kima Ventures, Westloop Ventures, Argonautic Ventures and UFP Fintech. Funds from the round will be used to release products for the real estate and special purpose vehicles spaces.

Kamma raises $1.6m in funding

Kamma, a RegTech platform for property licensing, has reportedly netted £1.6m in its funding round. The capital injection was led by Triple Point, with contributions also coming from Pi Labs and M7 Structura. Funds from the round will be used to deepen its global search engine for local legislation, whilst supporting its goal of improving property law in the UK.

Credit platform Koto nets £1.3m

Koto has closed a £1.3m funding round, launched its platform and is now looking to reach 50,000 users in the UK. The company will also use the capital to further train its AI-powered credit risk systems, expand its operational capacity, enhance its marketing efforts and hire more staff. Koto aims to help the 12 million people in the UK that are excluded by mainstream lenders. Its mobile app offers two types of credit to users. The first is a traditional credit card, which allows users to borrow a set amount.

Artivatic.ai picks up investment from Scale Ventures and IAN

India-based InsurTech startup Artivatic.ai has raised what it refers to as a bridge funding round led by Scale Ventures and existing investor IAN. While neglecting to divulge how much money was raised, the venture will use the money to fund its research and further development of its platform.

F1 Payments secures recapitalisation and growth investment

FinTech F1 Payments has picked up a strategic recapitalisation and growth investment from private investment house York Capital Management. The company aims to deliver quick, secure and easy-to-use payments services to financial agents, merchants and institutions.

Copyright © 2020 FinTech Global