FinTech deal activity nearly tripled in the first quarter compared to Q1 2020 as companies completed 50 funding rounds

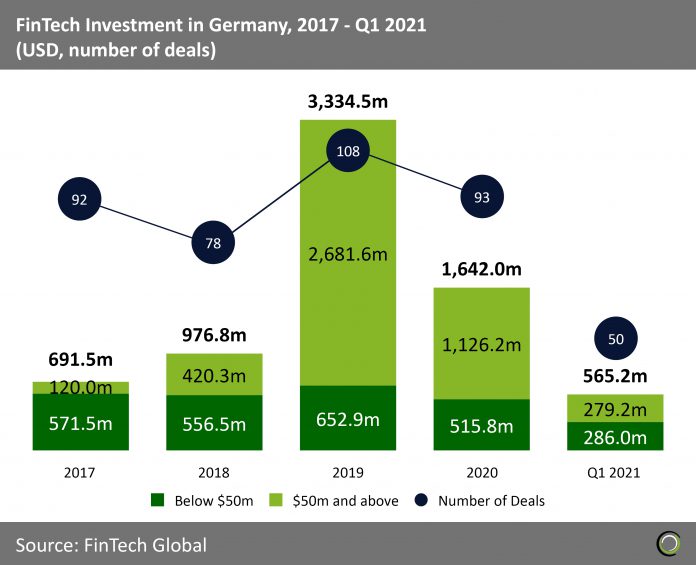

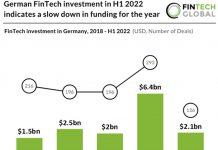

- FinTech companies in Germany raised just over $5.0bn across 278 deals between 2017 and 2019. Funding more than quadrupled over the period to a record high of $3.3bn in 2019. The record amount was driven by nine deals completed over $100m.

- Despite the momentum, the German FinTech sector had a challenging 2020 brought about by the economic uncertainty around the pandemic and the bankruptcy scandal surrounding Wirecard, the payment processing giant. Funding to the sector halved to just over $1.6bn while deal activity also declined to 93 transactions from 108 funding rounds recorded in 2019.

- However, investment in the country had a strong start to 2021 with $565m worth of funding, a huge uptick on the $84m invested in Q1 2020. Deal activity also recovered YoY from 18 transactions last year to 50 deals in the first three months of 2021.

Large deals return as German companies completed seven funding rounds at €25m or above in Q1 2021

- Last year’s decline in funding was driven by the lack of large deals – only 13 transactions at €25m or above were recorded. The opening quarter of 2021 bodes well for the German FinTech sector with seven transactions in that size bracket were recorded.

- The largest deal of the period was completed by Mambu, a software-as-a-service banking engine provider that powers lending and deposit services, which raised €110m in a Series D round lead by TCV. The transactions valued the company at $2.07bn and the fresh funds will be used to fuel its growth and strengthen its footprint in over 50 countries.

- All transactions are at the Series A stage or later, except Remagine, a finance platform for businesses, which completed a huge €20m Seed investment. The funds will be used to accelerate its product development and expand its team. The company has already provided over 20 revenue-based financings to startups, while operating in stealth mode.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2021 FinTech Global