Solaris, a prominent figure in the German FinTech sector, is experiencing hurdles as it tries to garner the necessary funding, casting shadows over its capability to fulfil a pivotal credit card agreement for ADAC, Europe’s leading motorists association.

The Munich-centred motor association, ADAC, is on the lookout for potential credit card collaborators since the Berlin-based banking-as-a-service entity, Solaris, has been stalling in its pursuit to lock down €100m required for the project, according to a report from the Financial Times which cites people with knowledge on the matter.

Previously, Solaris bagged a decade-long contract, promising to supply ADAC-themed credit cards to the club’s vast 21 million member base. ADAC, with its 1.3 million active credit cards, boasts one of Germany’s most expansive co-branded portfolios. This arrangement was a noteworthy achievement for Solaris. The company had projected this deal to spike their yearly sales upwards of €100m, a significant leap from their prior year’s income of €130m.

However, heightened interest rates have made investors cautious, limiting their willingness to invest in start-ups vying to reshape the financial realm.

A portion of the €100m that Solaris is chasing is designated to cover an upfront payment to ADAC. The major share is meant to cater to the regulatory capital requirements derived from managing ADAC credit cards’ massive €500m loan ledger.

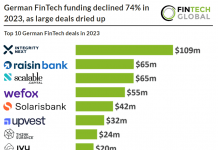

In a separate development, Solaris, boasting a German banking licence, managed to attract €38m from its standing investors in July. The primary aim was “to bolster governance and adherence to regulations.”

On-going negotiations between Solaris and its present sponsors, including significant names like US credit card conglomerate Visa and Spanish bank BBVA, about the proposed €100m have been stalled due to the unfavourable market conditions, as per sources close to the developments.

Solaris declared a yearly loss of €56m for 2022, equating to 43% of its earnings. Since its inception in 2015, Solaris has accumulated funding amounting to €440m. Valuations in 2021 and 2023 placed the budding firm at a commendable €1.6bn.

Come June, ADAC disclosed a half-year delay in transitioning its credit card clients to Solaris, now anticipated to culminate by mid-2024. Contrary to assumptions, insiders suggest that the delay is not rooted in funding issues but rather technical glitches encountered with an external service provider.

ADAC has reached out to financial institutions like DKB, Deutsche Bank, and Hanseatic bank – all contenders for the initial contract. Discussions are centred around one of these banks potentially absorbing the hefty €500m loan portfolio, effectively reducing Solaris’s urgency for additional regulatory capital.

Presently, discussions between Solaris, the motor association, and potential allies are in progress, with hopes of resolution by the year-end.

ADAC’s wavering confidence is but a new obstacle for Solaris, which previously felt the blow from the bankruptcy of a major client, neobank Nuri. Additionally, the German financial overseer, BaFin, criticised Solaris for structural shortcomings. This scrutiny has led to stricter capital prerequisites and vetting of new clientele.

Keep up with all the latest FinTech news here

Copyright © 2023 FinTech Global