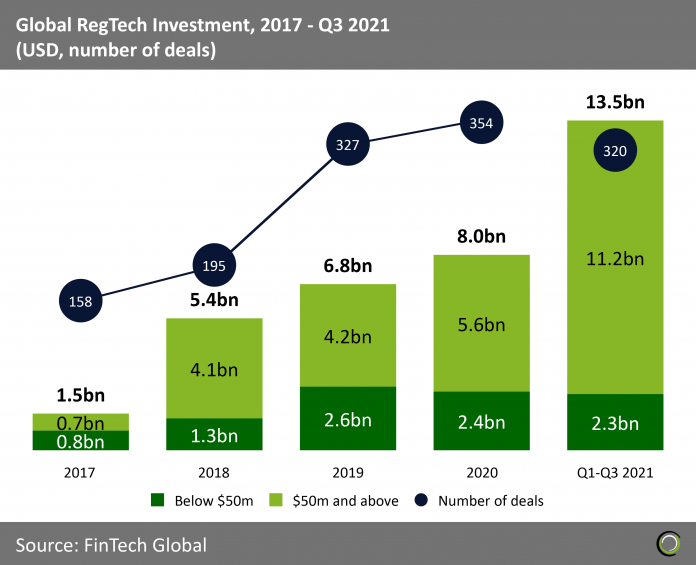

RegTech companies raised $13.5bn across 320 deals in the first nine months of the year driven by large transactions over $100m

- Global RegTech investment between 2017 and 2020 increased exponentially as investors increasingly backed companies looking to solve and bring efficiency to outdated compliance processes. Additionally, new regulations such as MiFID II and GDPR, introduced in 2018, opened up new markets for technology solutions helping financial institutions comply with the complex rules. Total funding grew at a CAGR of 74.7% over the period from 1.5bn to nearly $8.0bn at the end of last year.

- The coronavirus pandemic only increased investors’ appetite for deals in the sector as the social distancing measures and flexible working arrangements forced financial services firms to employ surveillance software and digital solutions to monitor online risks and remote staff’s conduct. Funding hit $13.5bn in the first three quarters of 2021, already surpassing the total capital invested in the whole of last year by 68.7%. The massive investment growth was mainly driven by 46 deals valued at $100m or more, compared to just 24 such transactions recorded in 2020.

- If we look beyond the huge funding numbers, the RegTech sector still saw strong levels of deal activity with 320 transactions completed in the first nine months of the year. That’s a 39.1% growth compared to the same period last year.

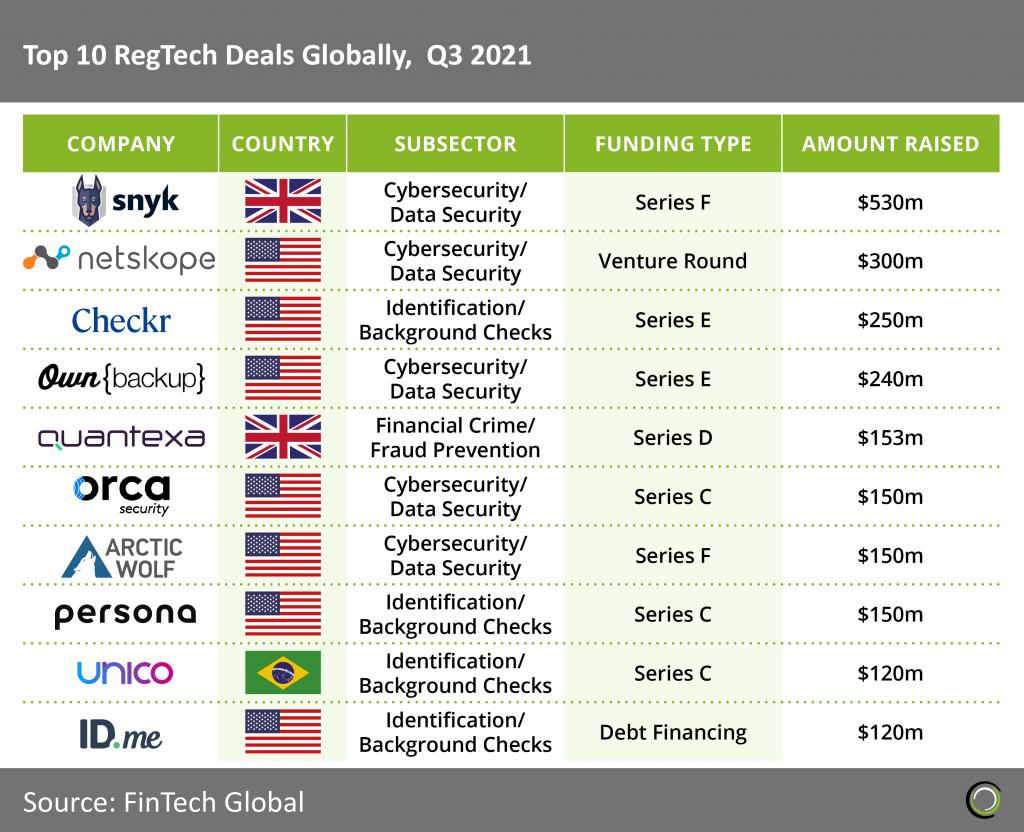

Cybersecurity and Identification/Background check companies dominated the list of top 10 RegTech deals in Q3

- The RegTech sector cooled off a little in the third quarter as companies raised $3.7bn worth of funding. That’s nearly 25% lower compared to the total capital raised during the second quarter of 2021 when the sector recorded $4.9bn in investment. Cybersecurity/Data Security completed five of the top ten deals on the list as the risk of fraud and online attacks continue to raise with the increased use of digital channels.

- The largest deal of the period was completed by Snyk, a cybersecurity platform that helps businesses to integrate security into their existing workflows, which raised $530m Series F valuing the company at $8.5bn. The fresh funds will further the development of its products, with new features to be announced later in the year. Funds will also be used to enhance its Developer Security Platform, build more workflow integrations and develop new features.

- Identification/Background check companies also saw strong interest from investors in the third quarter with four companies on the list. The largest deal in the subsector was completed by Checkr, a company conducting background checks on gig economy workers, which raised $160m Series E led by Durable Capital Partners. Checkr will use the money to expand the functionality of its platform, improve accuracy and fairness while creating new products to better serve customers. It will also develop new international capabilities to align with the expansion plans of our customers operating globally.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global