New Zealand’s Earthquake Commission (EQC) is to use new modelling software to boost its ability to plan for future natural disasters and respond to them.

The EQC is a Crown Entity responsible for providing residential natural disaster coverage, including earthquakes, landslides, tsunamis, and volcanic eruptions, throughout New Zealand.

In conjunction with two of New Zealand’s leading crown research institutions, EQC is now using GNS Science and NIWA’s sophisticated risk modelling tool RiskScape to model damage and losses from earthquakes.

The new loss modelling tool is being used for reinsurance modelling to start, with scenario planning being incorporated in the coming year. It replaces the Minerva platform that EQC has been using for 20 years.

The new modelling software will allow EQC to continuously bring its wealth of research and insurance data into its risk modelling, creating an increasingly comprehensive picture following an event, as well as improving EQC’s ability to model and plan for future disasters.

The organisation said understanding natural hazards and their potential impact is vital for New Zealand’s physical and economic security.

EQC’s head of risk modelling Andrea Gluyas, said that as the relevant science develops, the new tool we will be able to model losses from other perils such as tsunami and volcanoes in the future.

“This new tool will allow us to incorporate the latest science to understand the impact of natural hazards on New Zealand homes, helping us to better plan for future events as well as providing critical information immediately after an event to help us best prioritise assistance to the most affected communities and scale our response accordingly.”

According to a report from Munich Re, the number of recorded loss events resulting from natural disasters has been increasing for some years now, causing overall losses of $210bn. Often, Munich Re said, only a tiny proportion of this damage is insured. While the insurance gap has diminished in recent years in industrialised countries, there is still a considerable gulf in developing and emerging countries.

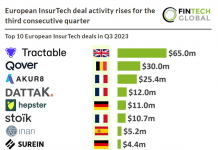

As the climate changes, we may also see insurance in this area evolve. Tractable recently launched a new solution to assess damage to buildings after natural disasters. The AI, which has been trained on a large database of claims and damaged property, makes an immediate assessment of the damage it sees and relays this to the homeowner’s insurer. Typically, this claims process can take months after a natural disaster, but Tractable’s app enables the process to start in one day.

Copyright © 2022 FinTech Global