Descartes Underwriting, Paris-based parametric-specialised provider of corporate insurance against natural catastrophe and climate risks, has formed a partnership with Reask, a tropical-cyclone risk analytics firm.

A report by Insurance Innovation Reporter said that according to a Descartes statement, the partnership aims to promote the advancement of parametric cyclone insurance products by combining Descartes’ ability to incorporate state-of-the-art technology into its parametric product design, with Reask’s wind speed data.

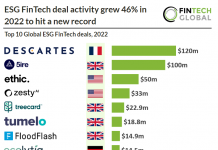

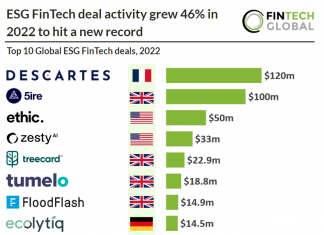

Descartes Underwriting works with corporate brokers to offer affordable insurance solutions to help their clients to manage their climate-related and emerging risks. The InsurTech recently raised $120m in Series B funding.

The climate InsurTech noted that last year, cyclone-driven economic loss was estimated to have reached $78bn worldwide, with 68% of losses ($53bn) not covered by insurance. Even in the more established North American market, Hurricane Ida, which carried an economic impact of an estimated $95bn, illustrates the windstorm coverage gap, with only $30bn or 32% of losses insured.

The partnership also seeks to address the insurance protection gap by expanding global cyclone parametric coverage.

Thomas Loridan, co-founder and CEO, Reask, said, “Our Metryc solution enables the transfer of financial risk in all corners of the globe, expanding the reach of parametric insurance solutions such as those provided by Descartes Underwriting.

“It is thanks to our machine learning approach to wind modelling that Metryc can be used as a reliable third-party view of tropical cyclone wind speed data even in regions where observations are scarce.”

Copyright © 2022 FinTech Global