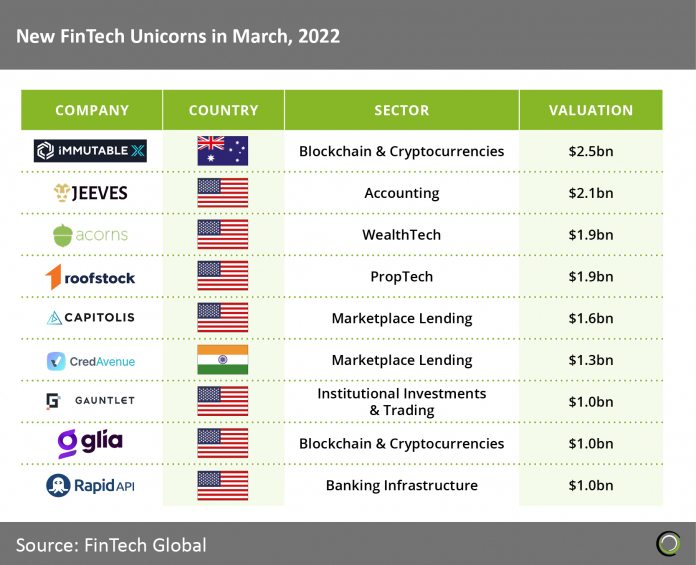

- March had the lowest amount of new FinTech unicorns announced this year with nine in total. This is a 31% decrease from January and February which both saw 13 new companies enter the coveted club. In total 35 FinTech unicorns have been announced in Q1 2022 which is a small 7% decrease compared to 2021 levels.

- Immutable X, which provides a blockchain infrastructure for asset trading, is Australia’s third FinTech unicorn and was the highest valued new FinTech unicorn in March raising $200m. Immutable X intends to utilize the funds raised to develop out its L2 scaling solution on Ethereum.

- The US had 17 new FinTech unicorns in Q1 2022 which is a significant 25% decrease compared to 2021 levels indicating VCs are backing earlier stage innovation. The unicorn investment stage is critical as they must prove their scalability and product viability before traditionally going public. FinTechs however may choose to stay private for longer due to poor IPO performances. Staying private allows for companies to scale rapidly at a loss while avoiding the scrutiny of the public markets.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global