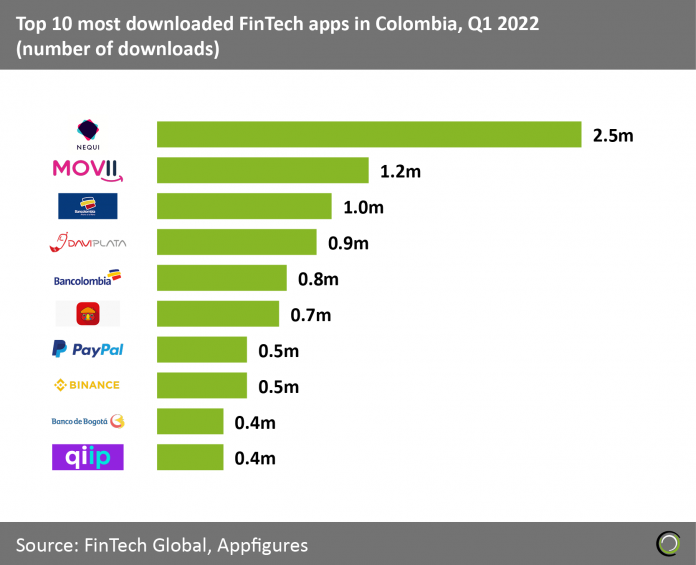

- PayTech companies accounted for half of the most downloaded FinTech apps In Colombia during the first quarter. WealthTech was the second most popular sector with 40% of apps on the list. With 54% of Colombia’s population unbanked in 2021 FinTech has a huge opportunity and part to play in Colombia’s economy. This significance can be seen by combining the total downloads for the apps listed in 2021 which came to 27m downloads, more than half Colombia’s population (Colombia’s population was 50.88m in 2020).

- Mobile is widely used and a significant factor in Colombia’s FinTech success, with 61m mobile connections occurring in January 2021, roughly 1.2 connections per person. This combined with ideal age demographics for FinTech adoption, 68% of Colombia’s population are between 15 -54 years of age, helping FinTech reach high adoption rates quickly.

- Nequi, a digital payments platform, was the most downloaded FinTech app in Colombia for Q1 2022 amassing 2.5m downloads. Nequi has 10.4m total downloads as of Q1 2022 and was developed by Bancolombia (the largest commercial bank in the country) in 2016 although in 2021 it split from the bank to improve and expand its platform.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global