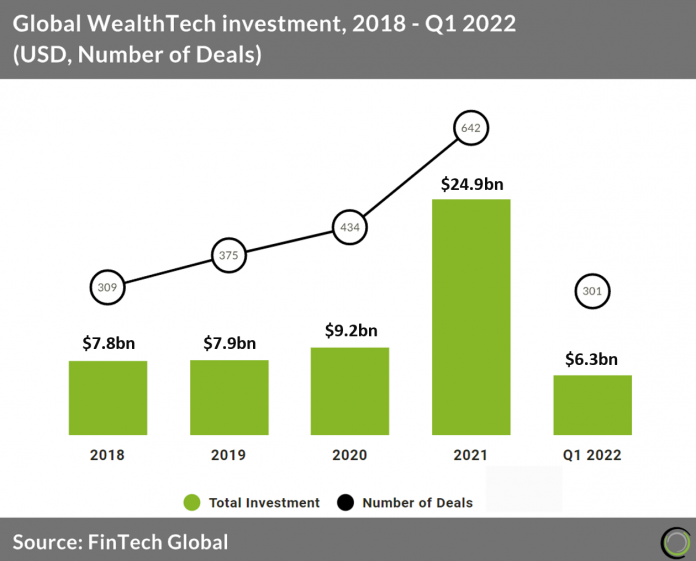

• The WealthTech sector recorded 301 deals in the first quarter of 2022 and if that pace continues deal actiovity is on track to exceed 1,200, an 88% increase from last year. Based on the capital invested in the opening quarter, investment in the sector is expected to reach similar levels to 2021 with a slight 1.2% increase from 2021.

• As the cost of living globally continues to increase and interest rates creep up, many FinTech sectors are facing lower usage fugyres and higher costs, including the largest sectors, PayTech and Marketplace Lending. WealthTech however is in a different lane with expected increases in usage as consumers keep a closer eye on their personal finances and are looking for alternative ways to save money.

• WealthTech deals were dominated by the US in the first quarter of 2022 accounting for 38% of total transactions and the country was second in the world for WealthTech investment with a 28% share of total investment in Q1 2022. The UK came first for WealthTech investment accounting for 30% of total investment in the sector at $1.9bn and had a 12% share of total deals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global