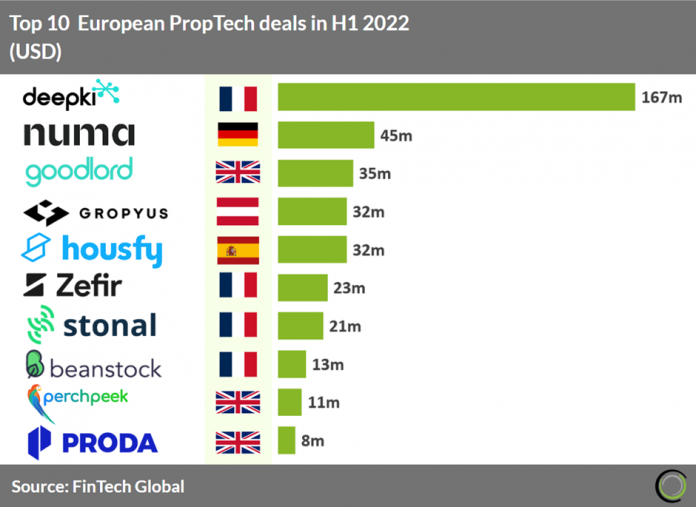

·France stands out in Europe, accounting for four of the top ten European PropTech deals listed, as well as 45% of capital invested in the sector across nine deals for H1 2022. The UK had the most deal activity with 23 deals in total, 28% of deals in the first half of 2022 although only accounted for 18% of funding raised. France’s large deals sizes and later stage funding rounds signal a maturing sector and will likely raise the most capital in Europe in the short term but the UK’s quantity of smaller deals signal more activity and innovation and will likely vie for the top spot in Europe.

· Deepki, a company tracking ESG data for the real estate sector, was the highest valued European PropTech deal in H1 2022 raising $167m in their latest Series C funding round led by Highland Europe and One Peak Partners. Deepki’s co-founders Vincent Bryant and Emmanuel said in a joint statement: “More than $5trn of investment is needed each year to decarbonise the built environment and ensure the real estate sector can meet its commitment of net zero by 2050. To achieve the target Deepki expects the monitoring and analytics segment within this goal to be worth $5bn to $10bn by 2025, with YoY growth of 20% and are positioning themselves as the key player in the market.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global