Key ESG FinTech investment stats in Q3 2023:

• ESG FinTech deal activity in Q3 2023 reached 17 deals, a 10% drop QoQ

• ESG FinTech companies raised a combined $18.1m in the third quarter, a 64% reduction from Q2 2023

• The UK was the most active ESG FinTech country globally in Q3 with eight deals, a 47% share of all transactions

Global ESG FinTech deal activity in Q3 2023 has fallen for the third consecutive quarter. In Q3 2023, ESG FinTech companies raised a total of 17 transactions, a decrease of 10% compared to the previous three-month period. ESG FinTech funding reached a combined total of $18.1m in Q3 2023, a 64% reduction from the second quarter. In the third quarter of 2023, ESG FinTech firms collectively secured $18.1m in funding, marking a significant 64% decrease compared to the funding raised in the second quarter of 2023.

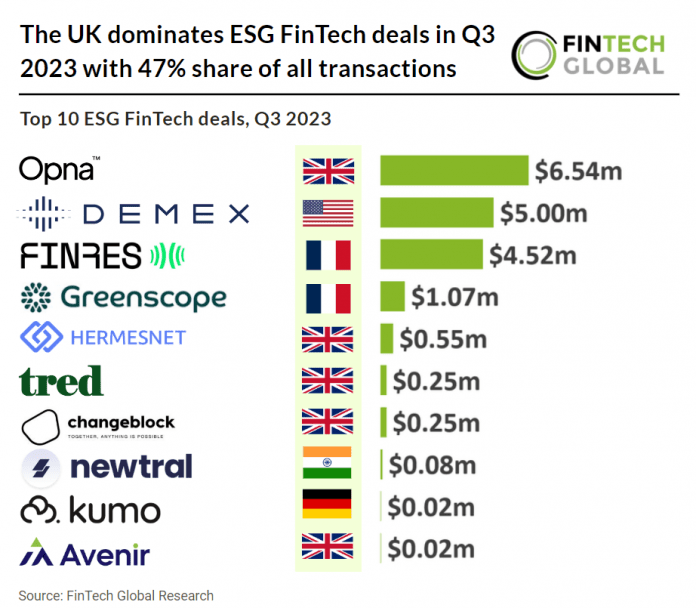

Opna, a financing platform for climate projects, had the largest ESG FinTech deal in Q3 2023 AFTER raising $6.54m (£5.2m) in their seed funding round, led by Atomico. The funds will be allocated towards two primary objectives: First, to enhance the visibility of the financing platform dedicated to supporting worldwide carbon projects and to advance the platform’s exclusive risk assessment engine. Second, the investment will enable the expansion of the range and quantity of available carbon projects, an increase in team size, and the creation of new financing and insurance services. Opna founder Shilpika Gautam said “To achieve their net zero commitments, an increasing number of corporates are seizing control by directly financing the carbon projects underlying the carbon credits. “However, these businesses are having a hard time mobilising their capital due to a lack of in-house expertise, high transaction costs, analogue infrastructure, and time-consuming processes. Opna’s goal is to provide the platform, data, and financing innovation that unlocks this capital, bridging the gap between corporates committed to reaching net-zero and carbon projects that seek financing.”

The UK was the most active ESG FinTech country globally in Q3 2023 with eight deals, a 47% share of deals. The USA, France and Germany all had two deals. Notably the USA saw a 66% drop in FinTech deals QoQ.

The latest government ESG regulation came on July 31st 2023 from the European Commission, which adopted the European Sustainability Reporting Standards (ESRS) and related guidance, setting a common framework for sustainability reporting under the EU Corporate Sustainability Reporting Directive 2022 (CSRD). CSRD applies to large companies and non-EU firms significantly active in the EU. The ESRS encompass general requirements, environmental, social, and governance disclosures. The European Parliament and the Council will review the Delegated Regulation, with no amendments allowed. The CSRD also mandates sector-specific standards and standards for SMEs, while collaboration with global organizations ensures alignment and avoids duplicate reporting.