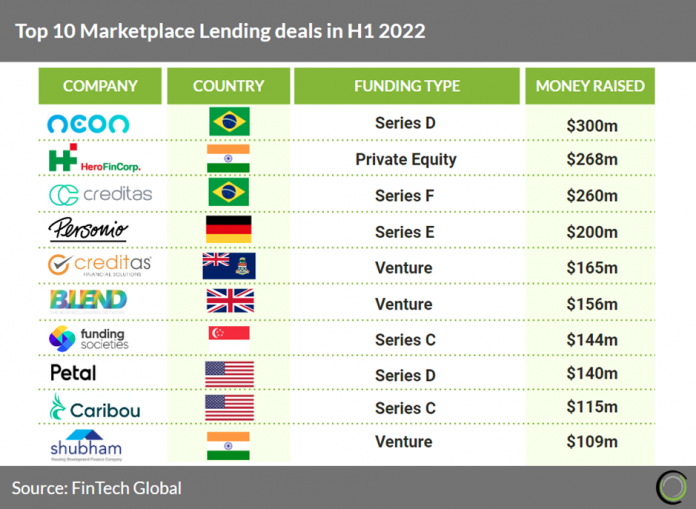

Neon, a digital bank offering credit cards and loans, was the largest Marketplace Lending deal during the first half of 2022 raising a considerable $300m in their latest Series D funding round led by BBVA. The company strategy is to launch new products based on its Democredit platform, proprietary intelligence for credit approval. Neon believes that this is a differential for the huge contingent of Brazilians who seek sustainable financing. ?BBVA investment and global expertise will allow Neon to offer loans in a more simple, sustainable and inclusive way. We want to reach more Brazilians, contributing to reducing inequalities and making a difference in their lives,Neon founder Pedro Conrade said.

Overall, there were 310 deals in the first half of 2022 indicating that deal activity in 2022 will surpass 2021 by 83% to 620 in total. Investment in the sector is likely to fall slightly by 3% although this is in line with global FinTech trends. The United States was the most active Marketplace Lending country with 108 deals, a 35% share of total deals and India was the second with 42 deals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.??2022 FinTech Global