India-based neobank Fi Money has reportedly collected an additional $17m for its Series C funding round.

Singapore-based investment firm Temasek Holdings supplied $15m to Fi Money, and existing investor QCM Holdings deployed $2m, according to a report from Your Story.

Fi Money previously raised $45m in its Series C round, which was backed by existing investor Alpha Wave Global. The FinTech company has now raised a total of $137.2m in funding, to-date, and is backed by Ribbit Capital, Sequoia Capital and B Capital.

The FinTech company offers a financial app with a digital savings bank account and a suite of tools to help users track their money. Its money management app, which is aimed at working professionals, comes with a zero-balance savings account and access to commission-free mutual funds.

Users can connect through other bank accounts to Fi to see a combined balance and transaction history. Other benefits of the service include no minimum balance, withdrawal from any ATM, no hidden fees, money insured of up to INR 500,000 and more.

The app also boasts an assistant function that lets users receive insights into their spending, savings, bills and more.

Earlier this month, fellow India-based FinTech company MobiKwik closed a $4.3m debt investment from Blacksoil Capital. The company offers instant bill payments, bank transfers, loans, wallet transfers and access to mutual funds.

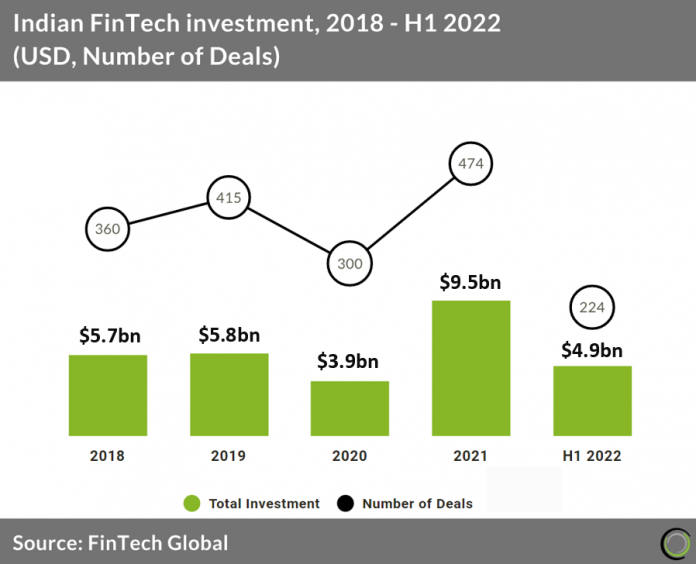

India FinTech sector slowed a little in Q2 2022 after a very strong start to the year. The country is now projected to reach $9.8bn, a 3.1% increase on the previous year. However, FinTech investment in the second quarter of 2022 reached $1.8bn, 42% lower than the first quarter of 2022.

In the 2021, a total of $9.5bn was invested through 474 deals, while the first half of 2022 has seen $4.9bn invested through 224 transactions.

Copyright ? 2022 FinTech Global

Copyright ? 2022 FinTech Global