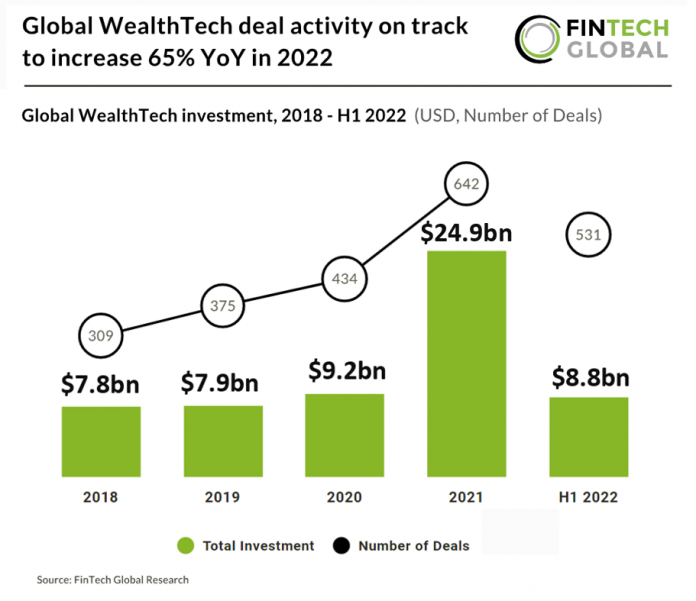

• The number of WealthTech deals globally is on track to reach 1,062 in total this year based on the number of funding rounds completed in the first half of 2022, up 65% from the previous year. On the other hand, investment in the sector is slightly underwhelming with projections estimating that total investment will reach $17.6bn, globally, in 2022, a 29% decrease from 2021. Investment in the second quarter only reached $2.5bn, a dramatic 61% drop from the opening quarter of the year.

• TIFIN, which provides investment-driven personalization using AI, was the largest WealthTech deal in H1 2022 raising a sizeable $109m in their latest Series D funding round led by Motive Partners which brought the company’s valuation to $842m. This capital, alongside existing funds from prior funding rounds will support TIFIN’s continued growth, with particular emphasis on Magnifi’s consumer platform, Distill’s expansion with asset and wealth enterprises, TIFIN’s expansion outside the US and additional FinTech innovation initiatives.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global