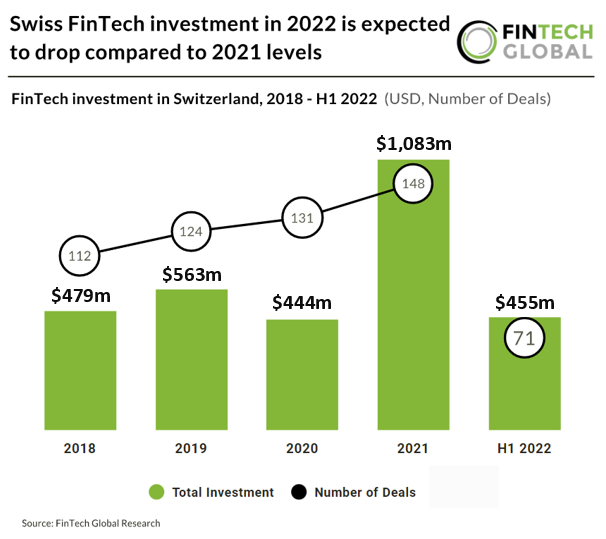

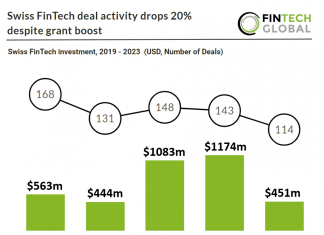

• Swiss FinTech investment is on track to drop 16% in 2022 based on investment in the first half of the year whilst deal activity is only projected to drop 4% indicating that appetite for fresh innovation among investors is still there.

• SEBA Bank, a cryptocurrency company that provides a seamless, secure, and an easy-to-use bridge between digital and traditional assets, was the largest FinTech deal in the first half of 2022 raising a $119m in their latest Series C funding round led by DeFi Technologies. The Swiss bank’s chief executive officer, Guido Buehler said “We plan to expand into a number of new priority markets globally with this funding, including the Middle East. This funding will also be used to grow our headcount across these new priority markets. In addition, funding will be used to drive institutional business growth through further investment in our product offering and technology.”

• Zurich was the most active FinTech city in Switzerland in H1 2022 accounting for 30% of Swiss FinTech deal activity with 21 deals although this was closely followed by Zug which announced 13 deals in the first half of 2022. Lots of FinTech companies set up in Zurich due to its financial hub and proximity to established financial institutions whilst Zug, also know as the Crypto valley is home to the majority of Swiss Blockchain & Crypto companies.

Other FinTech news in the DACH region

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global