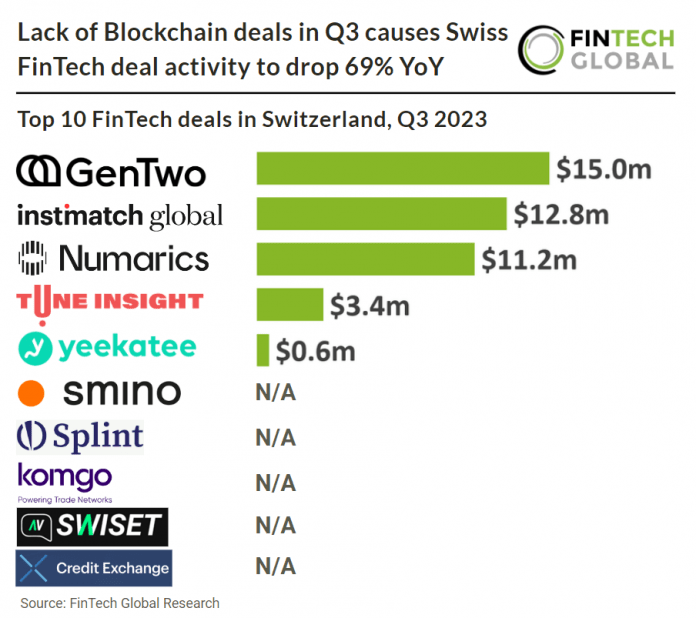

Key Swiss FinTech investment stats in Q3 2023:

• Swiss FinTech deal activity reached 10 deals in Q3 2023, a 69% drop from Q3 2022

• Swiss FinTech companies raised a combined $43m in the third quarter, a 95% decline YoY

• Zurich remained the most active FinTech city in Switzerland with a 60% share of deals

Swiss FinTech has seen a dramatic drop in both deal activity and investment which can be attributed to the global drop in FinTech funding but also the decline in Blockchain & Digital Asset deals which accounted for a third of all transactions in the sector in 2022. Swiss FinTech deal volume plummeted in Q3 2023, recording a significant 69% decline compared to the same quarter in 2022, with a total of only 10 deals reported. In Q3 2023, Swiss FinTech firms collectively secured a total of $43m in funding, marking a substantial 95% decrease compared to the previous year.

GenTwo, a white-label platform to create investment products, had the largest Swiss FinTech deal in Q3 2023 after raising $15m in their latest Series A funding round from Point72 Ventures. The firm plans to utilize the capital for international expansion and to further enhance its financial engineering platform. As of September 2023, the company has catered to over 250 clients across 26 countries, facilitating the launch of well over 1,200 investment products, and managing an impressive portfolio exceeding USD 3 billion in Assets under Service (AuS).

Zurich remained the most active FinTech city in Switzerland with six deals, a 60% share of total deals. Zug which was a hotbed for new Blockchain & Digital Asset companies in 2022 only saw two deals despite almost overtaking Zurich as the most active Swiss FinTech city.