RegTech company SteelEye has warned that small companies will soon be in the firing line for fines for failing to comply with off-channel communication.

Over the past 12 months, the financial institutions including Morgan Stanley, Barclays Capital, Bank of America, Citigroup, and JP Morgan have received multi-million-dollar fines for failing to monitor or prevent their workers using unauthorised messaging apps.

These messaging apps include services like WhatsApp, iMessage, WeChat, Telegram and Signal.

SteelEye explained that Us regulators have fined 16 financial firms a combined total of $1.8bn. The SEC also warned broker-dealers and asset managers that they would be “well-served to self-report and self-remediate any deficiencies.”

Apollo Global, Carlyle Group, KKR & Co all recently announced they are also under investigation by the SEC for having allowed employees to use unauthorised communication channels.

SteelEye president of Americas Brian Lynch said, “By targeting some of the biggest players in the financial services sector with significant fines, regulators are sending a message to the entire industry that off-channel communications will not be tolerated – emphasising the severity of getting caught.

“However, given that so far, it is only the larger financial institutions that have been targeted, it would also appear that regulators are giving the rest of the market a chance to take a more proactive approach and address any deficiencies in their record-keeping themselves and avoid regulatory action.”

Research from SteelEye found that 20% of firms say that keeping up with regulatory change is their biggest compliance challenge. This figure increases to 32% for small firms.

Its report also found that only 11% of firms view “increasing the coverage of different communications channels” as a priority for the next 12 months. This figure drops to 4% for small firms.

Finally, its study found that only 12% of small firms are currently monitoring WhatsApp – increasing to 15% overall.

Lynch added, “Smaller firms need to ensure they have robust processes and policies in place to meet their regulatory obligations – particularly when it comes to communications compliance – before the regulatory scrutiny turns to them,” says Brian. “Firms also need to ensure that any investments they make allow them to future-proof their operations so that they can continue to meet requirements as regulatory or operational circumstances change.”

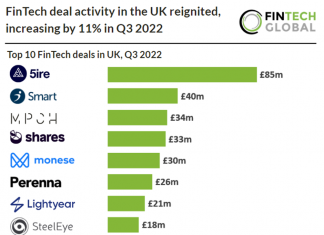

Earlier in the year, SteelEye raised $21m from a Series B round led by Ten Coves Capital.

Copyright © 2022 FinTech Global