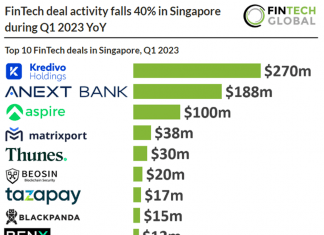

Matrixport, a digital assets financial services platform, is reportedly planning to raise $100m.

According to a report from Decrypt, if successful, the new funding would value the Singapore-based company at $1.5bn, an increase from the valuation of over $1 billion achieved during its Series C funding round in August 2021.

C Ventures, K3 Ventures and partners of DST Global served as the lead investors to the round. Additional commitments came from Qiming Venture Partners, CE Innovation Capital, Tiger Global, Cachet Group, Palm Drive Capital, Foresight Ventures and A&T Capital.

Some of Matrixport’s existing backers also joined the Series C, including Lightspeed, Polychain, Dragonfly Capital, CMT Digital and IDG Capital.

Founded in 2019, the company hopes to be a one-stop financial services platform. The company currently offers a full suite of cryptocurrency financial services. Its features include institutional custody, trading, structured products and asset management.

Matrixport claims it is the world’s first crypto dual currency product.

John Ge, Matrixport co-founder and CEO, said at the time of the company’s Series C raise, “We are more than a gateway to the crypto economy. Matrixport is where both institutional customers and individuals find it easy to get more from their crypto, beyond just trading. We are continually pushing out more new ways to invest crypto and earn yields in a safe and sustainable manner.

“We believe that it is very important to give the choice back to our customers with a range of innovative crypto investment products.”

Earlier this year, Africa-focused digital assets exchange KoinKoin revealed it is eyeing global expansion as its annual revenues exceed $40m in OTC transactions.

As part of these expansion plans, KoinKoin aims to double its headcount of 15 staff members across its offices in Nigeria and Ghana, as well as bolster its C-suite team which is operating out of London.

Copyright © 2022 FinTech Global