South East Asian FinTech investment stats in Q1 2023

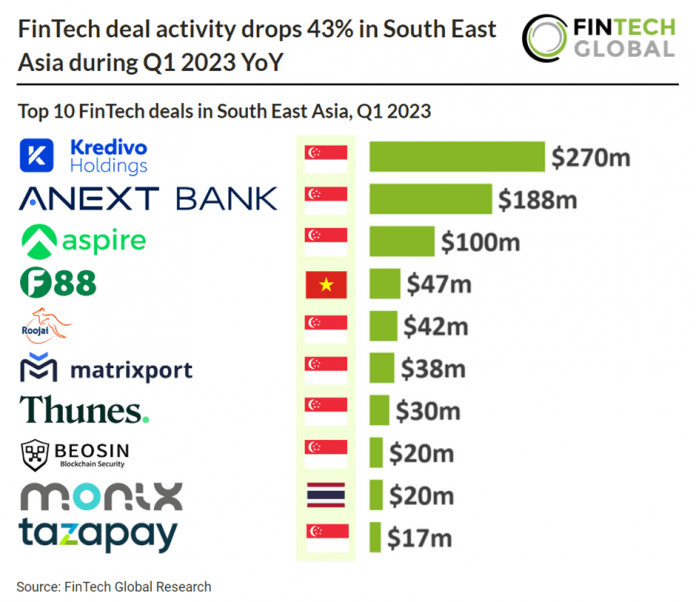

• South East Asian FinTech deal activity reached 74 deals in the first quarter of the year, a 43% drop from Q1 2022

• Investment raised from South East Asian FinTech companies reached $951m in Q1 2023, a 39% reduction from Q1 2022

• Singapore was the most active FinTech country in South East Asia during Q1 2023 with a 62% share of deals

FinTech investment in South East Asia saw a drop in both deal activity and investment during Q1 2023. In Q1 2023, investment raised by South East Asian FinTech companies amounted to $951m, marking a 39% decrease compared to Q1 2022. The number of deals in South East Asia’s FinTech sector reached 74 in Q1 2023, reflecting a 43% decline compared to Q1 2022.

Kredivo, which provide a wide range of financial services including BNPL and loans, was the largest FinTech deal in South East Asia during the first quarter of 2023 raising $270m in their latest Series D funding round, led by Mizuho Financial Group. The company says the new capital will be deployed to support its existing ecosystem of digital payments and credit service and to finance the upcoming launch of its neobank Kroo. Akshay Garg, CEO of Kredivo Holdings, says: “Despite challenging market conditions, investors continue to recognize the scale and strength of our business, and our innovation potential. The upcoming expansion into digital banking is deeply synergistic with the existing Kredivo product and also opens up a very promising channel for us to become the digital financial services platform of choice for tens of millions of consumers in Southeast Asia.”

Singapore was the most active FinTech country in South East Asia during Q1 2023 with 46 deals, a 62% share of total deals. Indonesia was the second most active country in the region with seven deals, a 9.4% share of deals and Malaysia was the third most active with six deals, an 8% share of deals.

Blockchain & Crypto was the most active Fintech subsector in South East Asia during Q1 2023 with 24 deals, a 32% share of total deals. Lending Technology was the second most active with 14 deals, an 18.4% share of deals and InsurTech was third with eight deals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global