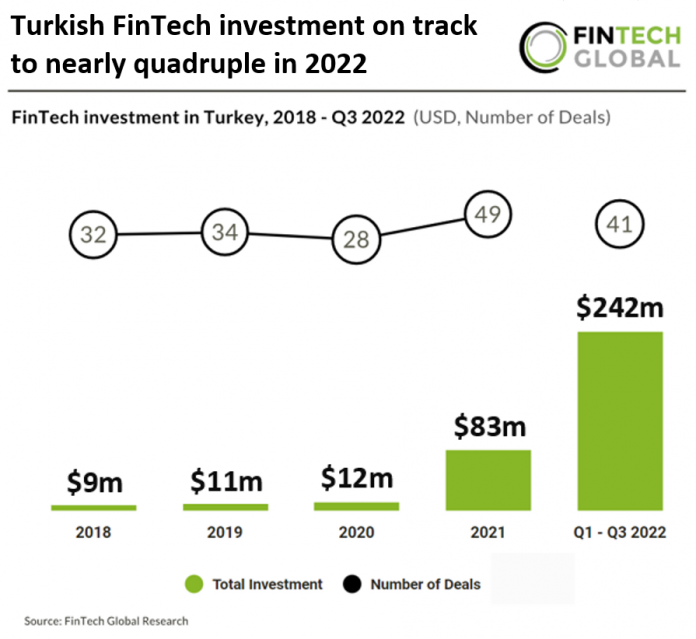

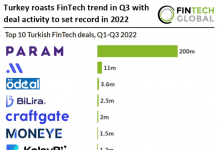

• Turkish FinTech investment is on track to set a new record in 2022, reaching an expected $323m in funding for the year based on investment pace in the first three quarters of 2022. This was bolstered by a sizeable $200m deal from Param which accounted for 83% of investment in Q1-Q3 2022. Deal activity in Turkey is also expected to set new records reaching 54 deals in total for 2022, a 12% increase from 2021 levels.

• Param, a payment service provider, was the largest FinTech deal in Turkey during the first three quarters of 2022 raising $200m in their latest Venture round, which included investment from Revo Capital, European Bank for Reconstruction and Development, Ceecat Capital and Alpha Associates. Param will use the funding to expand globally while strengthening its foothold in Turkey. The company said it operates 5.4m cards across 138 business-to-business-to-consumer card programs, facilitating payments for more than 90,000 merchants, including leading e-commerce players and large organizations.

• Istanbul was the most active FinTech city in Turkey from 2018 – Q3 2022, accounting for 65.7% of FinTech deal activity in the country with 121 deals in total. Ankara was the second most active FinTech city with 21.1% and Kocaeli was third with 5.4%.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global