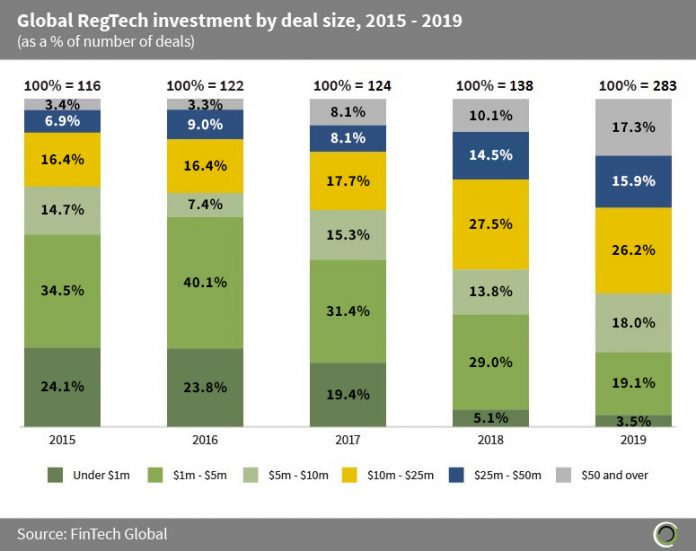

More than one in six RegTech deals were valued at $50m or above in 2019

- There has been a shift in the RegTech landscape between 2015 and 2019 from investors predominantly backing smaller deals, towards participating in more later-stage transactions.

- The proportion of RegTech deals valued below $5m fell by 36 percentage points (pp) from 58.6% back in 2015 to 22.6% in 2019, as the industry shows continued signs of maturity.

- Back in 2015, only 3.4% of deals were valued at $50m and over, but this has increased significantly with 17.3% of deals in 2019 being in this size range. Since the financial crisis, banks have faced an increase in new laws and regulations at a rapid pace, hence RegTech solutions have become essential to remaining compliant. As a result, banks have been forced to increase their compliance spending, therefore backing larger deals in the space.

- Average deal size increased over 3.5x during the period from just $7.5m in 2015 to $26.8m in 2019 as we see investment in RegTech companies increase at a higher rate than the volume of deals completed.

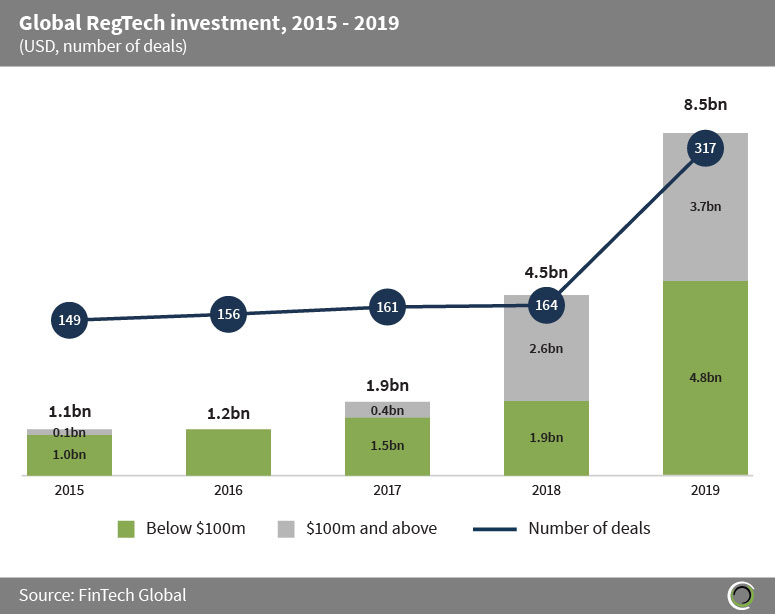

Global RegTech investment surged above $8bn in 2019

- RegTech companies have raised over $17bn since 2015 across 947 transactions with 39.7% of this funding raised in deals valued $100m and above.

- Investment increased at a CAGR of 66.7% between 2015 and 2019, reaching a record in 2019 of $8.5bn across 317 transactions. This record year has been driven by large deals valued at $100m or more, with 22 deals of this size being raised in 2019 compared to only seven in the previous record year, 2018.

- Out of the $8.5bn that was raised in 2019, 33.9% was raised in Q3 2019, across 76 deals, marking the strongest quarter for RegTech funding to date.

- Deal activity also hit a record in 2019 with 317 RegTech transactions completed globally, a 93.3% increase on 2018’s total.

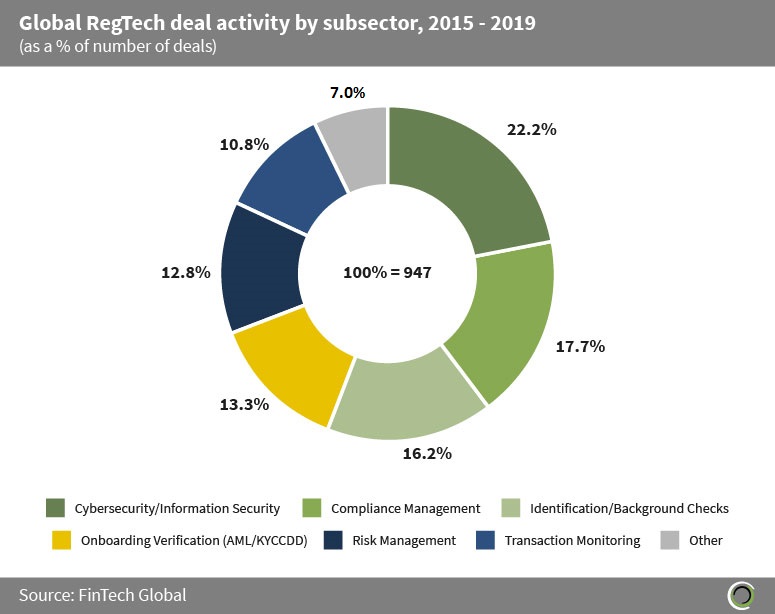

Investors have allocated capital across the whole RegTech value chain since 2015

- Over the past five years, investors have widely distributed capital across all RegTech subsectors as they look to diversify their portfolio of companies. Cybersecurity/Information Security, Compliance Management and Identification/Background Checks companies captured the greatest amount of investment during the period, collectively accounting for 56.1% of all transactions.

- Companies offering Cybersecurity/Information Security solutions captured the most deals during the period with 22.2% of deals being raised by companies in this subsector. Cybersecurity companies provide software and technology solutions that specifically address the challenges of financial regulations such as KYC and GDPR. Cyber threats pose a key challenge to the regulatory technology ecosystem; hence cybersecurity solutions have emerged as an attractive investment opportunity for investors in the space.

- Compliance Management solutions have attracted 17.7% of global RegTech transactions since 2015. The largest of these deals came from Rubrik, which provides GDPR-compliant cloud data management solutions to manage, protect and monitor data across multiple environments. The company raised $261m in a Series E round in Q1 2019 led by Bain Capital Ventures and reached a value of $3.3bn upon completion of the round.

- The Other category consists of companies with solutions in Capital Planning/Stress Testing, Reporting and Communications Monitoring which collectively account for 7.0% of RegTech deals between 2015 and 2019.

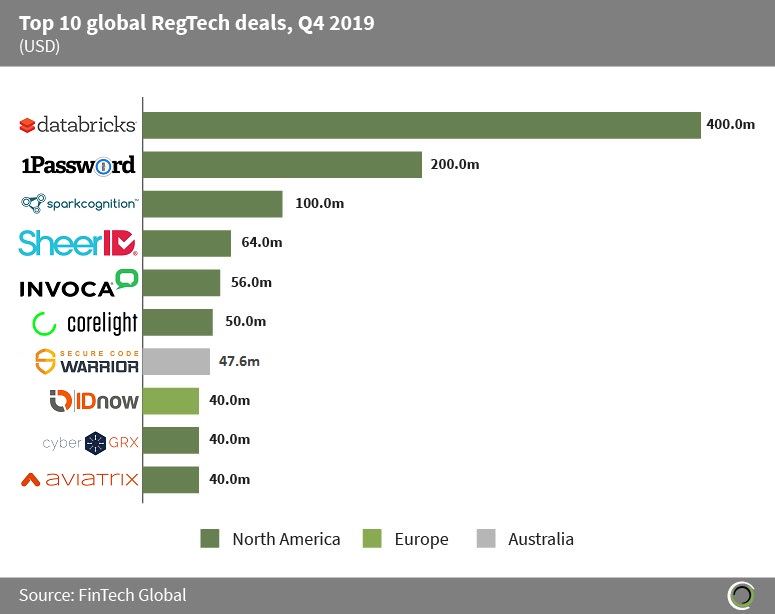

The top 10 RegTech deals in Q4 2019 raised over $1bn

- Over $1bn has been raised in the top 10 RegTech transactions globally in Q4 2019, which is equal to 54.5% of the total capital raised in the sector during the period. North American companies dominate the list with eight of the ten deals being completed in the country. Of the eight deals, seven were completed by US companies with the remaining deal being raised by a Canadian company.

- Databricks, a company specialising in unified analytics used by cybersecurity teams to identify potential threats and tackle any risks at an accelerated rate, raised the largest round of the period. The company raised $400m in a Series F led by Andreessen Horowitz’s Late Stage Venture Fund. Upon completion of the round, Databricks reached a valuation of $6.2bn.

- Secure Code Warrior raised $47.6m in a Series B led by Goldman Sachs in December 2019, making it the largest US investment of its kind in an early stage Australian cybersecurity company. The capital will be used to support product innovation and expansion into the Asia-Pacific region via Singapore.

- The largest deal raised by a company in Europe came from IDnow, an identity verification as a service solution which helps firms with their fraud prevention and online security. IDnow raised $40m in a growth equity round from Corsair Capital. The company will use the capital to increase expansion into European markets and new industries.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global