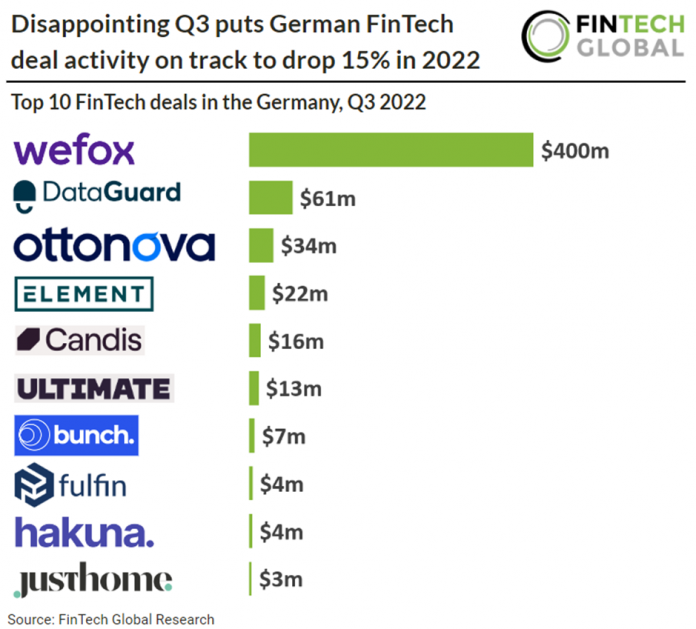

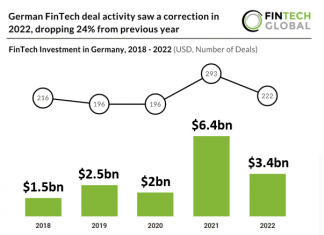

• German FinTech companies announced 43 deals in Q3 2022, projecting their total deals for 2022 to reach 249. Germany’s FinTech deal activity in Q3 2022 dropped 20% from Q2 levels. German FinTech investment is expected to reach $3.7bn in 2022, based on investment during the first three quarters of the year. This would be a 42% drop from 2021 when funding reached $6.4bn.

• wefox, a fully digital insurer, was Germany’s largest FinTech deal in the third quarter of 2022 raising $400m in their latest Series D funding round led by Mubadala and included seven other investors. This deal represented 60% of Germany’s FinTech investment in Q3 and pushed wefox’s valuation to a huge $4.5bn. wefox intends to use the funding for product development and expand across Europe and thereafter Asia and the US. wefox generated more than $200m in the first four months of business in 2022 and is well on target to reach more than $600m revenues by the end of the year.

• WealthTech was the most active FinTech sector in Q3 2022 with 11 deals, a 25% share of total deals. Online banking has taken over traditional banking methods in the country with 73% of the population using the service, while 58% handle their banking primarily via a smartphone app, 50% use a tablet app.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global