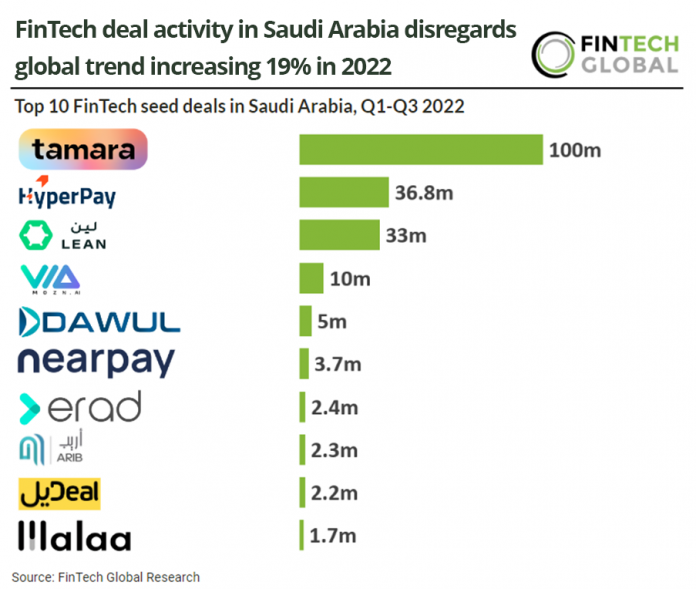

- FinTech deal activity in Saudi Arabia reached 25 deals in the first three quarters of 2022 increasing 19% compared to the same period in 2021. Saudi Arabian FinTech deal activity is on track to reach 33 deals in 2022. Saudi Arabian FinTech investment reached $313m in the first nine months of 2022 and is on track to reach $417m based on this period. This is in contrast to developed FinTech ecosystem which are experiencing a correction this year on the back of big rounds of investments recorded last year.

- Tamara, a buy now pay later service, was the largest FinTech deal in Q1-Q3 2022 raising $100m in their latest Series B funding round led by Sanabil. The company said the funding would support the Saudi-based startup to expand into new markets and introduce new services and products. It did not specify which markets. Chief Executive Abdulmajeed Alsukhan stated, “We believe the region has a different situation today than globally. The region is thriving with high oil prices, and we want to make sure our customers find the right products that suit them and find amazing deals.” Alsukhan also shared, “We believe that the interest rate as of today is still manageable. However, there is no doubt that in such a business that if interest rates goes way beyond where it is today, then it’s definitely problematic to all.”

- The Saudi Central Bank (SAMA) currently operates a FinTech sandbox. This sandbox was introduced in its efforts to contribute to Saudi Arabia’s Vision 2030 and diversify the economy. In 2020, SAMA approved the introduction of new laws governing the FinTech sector, notably debt-based crowdfunding and payment service provider (PSP) activities in Saudi Arabia.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global