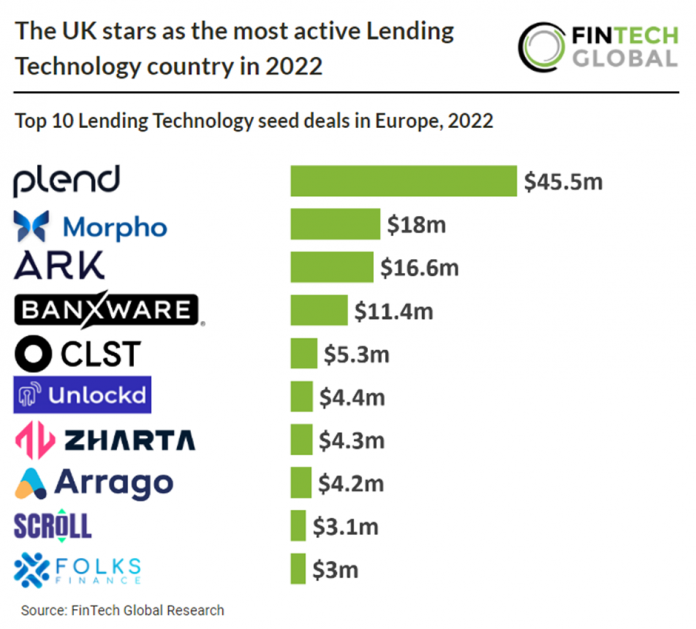

Key Lending Technology Seed Statistics 2022:

• European Lending Technology startups raised 66 seed deals in 2022

• The UK was the home to the highest number of deals with 22 transactions

• The average size of Lending Tech seed deal in Europe was $3m last year

European Lending Technology companies raised a total of 66 deals in 2022, accounting for 11% of all European FinTech seed deals in 2022. The UK was the most active Lending Technology country in 2022 with 22 deals, a 33% share of total deals. France was the second most active country with nine deals and joint third were The Netherlands, Germany and Switzerland with four deals each. European Lending Technology seed deals in 2022 raised a total of $199m over 66 deals hence a $3m average deal size.

Plend, a personal lending platform, was the largest European Lending Technology seed deal in 2022, raising $45.5m in their seed funding round. The funding includes existing pre-seed investors, Ascension, Tomahawk VC, DD Venture Capital and Haatch who have doubled-down on their original commitments in the wake of post-launch growth and our above-expected loan performance. The investment will be used to help scale the business into 2023, focusing on acquisition of new customers via new partners and reaching new audiences who find themselves excluded from the current credit system.

Peer to peer (P2P) lending has seen the most recent regulatory updates in the Lending Technology sector. From November 2022 all P2P sites operating in the EU will need to be licensed ‘Crowdfunding Service Providers’. P2P lending platforms are now required to ensure all the information is ‘clear, complete and accurate’. Borrowers must provide links to their most recent financial statements, and 3 years of key financial figures. Borrowers must disclose if they have defaulted on loans in the previous 5 years.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global