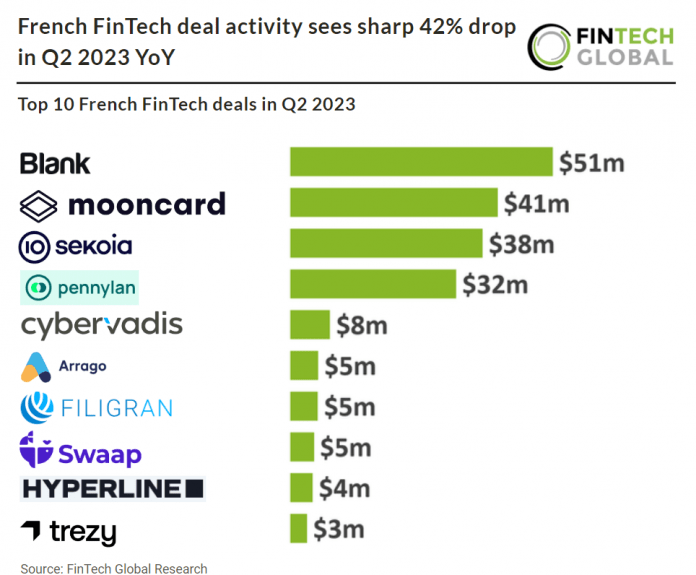

Key French FinTech investment stats in Q2 2023:

• French FinTech deal activity reach 40 deals in Q2 2023, a 42% drop YoY

• French Fintech companies raised a combined $222m in Q2 2023, a 53% reduction from Q2 2022

• RegTech was the most active French FinTech subsector with a 32% share of deals

France follows global trends seeing a decline in both deal activity and investment in the FinTech sector during Q2 2023 compared to the previous year. In the second quarter of 2023, the number of French FinTech deals reached 40, reflecting a significant YoY decline of 42%. In Q2 2023, French FinTech companies collectively secured $222m in funding, representing a substantial 53% decrease compared to the same period in 2022.

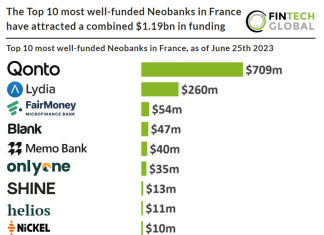

Blank, a digital bank, was the largest FinTech deal in France during Q2 2023, raising $51m in their latest Series B funding round, led by Crédit Agricole. Launched in 2020 as part of La Fabrique by CA, the startup studio of Crédit Agricole Group, Blank is a venture aimed specifically at professionals who work alone or in small teams within their companies. Simon Parisot, co-founder and CEO of Blank, explains that the neobank offers various services to simplify and secure company management, including the creation of legal structures, obtaining official registration documents (such as kbis), payment methods, and a range of non-banking solutions that assist with freelance tasks like invoicing, quoting, and accounting. In addition to its own brand, Blank also provides its white label services to LCL and Crédit Agricole banks. Over the past eight months, the company has been progressively introducing its products to other brands. As part of its expansion plans, Blank intends to hire 50 new employees by the end of the year to reinforce its workforce, solidify its position in France, and initiate its European expansion, starting with Italy.

RegTech was the most active FinTech subsector in France with 13 deals, a 32% share of total deals in the country. Financial Infrastructure was the second most active FinTech subsector with eight deals, a 20% share of deals and WealthTech and InsurTech were the joint third with four deals each.

France has implemented a specific tax framework for crypto-assets, with a tax regime that treats exchanges between “qualifying” crypto-assets as tax-neutral for individuals. However, converting a “qualifying” crypto-asset into fiat currency incurs a flat 30% tax rate (or progressive income tax scale from January 1, 2023). Capital gains on crypto-assets not covered by the specific tax regime are subject to taxation as commercial or non-commercial income at the progressive personal income tax scale, potentially reaching 49% plus applicable social security contributions. Individuals must declare their foreign crypto-asset accounts annually. The 2022 Finance Bill amended the tax regime, stating that from January 1, 2023, capital gains on crypto-assets will be taxed as non-commercial income if made under professional-like conditions and as commercial income if made on a professional basis. The French tax authorities are expected to release guidelines to differentiate between private wealth management and professional-like crypto-asset gains.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global