French neobanks may face challenges in staying competitive due to their close association with incumbent banks like Boursorama Banque and Société Générale. While these traditional banks have ventured into the neobank space, their close ties to the existing banking system could hinder the agility and innovation typically associated with neobanks. Additionally, the popularity of other European neobanks, such as Revolut, poses a threat to the growth of French neobanks. Revolut, in particular, has gained significant traction with its international money transfer services and diverse offerings.

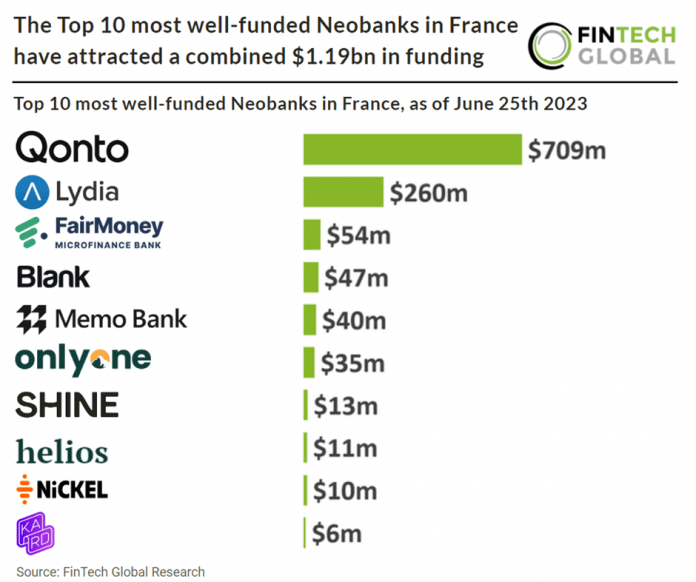

Qonto, an all-in-one bank account for SMEs, is the most well-funded neobank in France, as of 25th June 2023 with $709m in funding. Qonto raised EUR 5m in their latest crowd investing round. This crowdfunding campaign was closed after six and a half hours seeing as the startup had reached its limit. Due to legal requirements, the maximum for the crowd investing round was EUR 5 million. According to Handelsblatt, a total of over 1800 Qonto customers took part from Germany, France, Spain, and Italy.

The French neobanking market is set to witness significant growth, with the transaction value projected to reach $272bn in 2023. This growth is expected to continue at an annual growth rate of 20.13% (CAGR 2023-2027), two percentage points higher than the global average, resulting in a total transaction value of $566bn by 2027. In 2023, the average transaction value per user in the neobanking market is estimated to be $31k.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global