Key Australian FinTech investment stats from 2022:

• 112 FinTech deals were announced in 2022, a 45% drop from 2021

• Capital invested in the country reached $1.7bn, a 55% drop from last year

• Sydney was the most active FinTech city with a 36% share of total deals

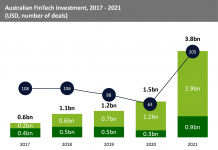

Australian FinTech has suffered in 2022 with both deal activity and investment dropping significantly from 2021 levels. Overall 112 deals were announced in the country during 2022, a 45% drop from the previous year and a clear signal of a downturn in the sector. Investment has also slowed down with a 55% reduction from 2021. This being said 2021 saw a record-breaking year for Australia with both deal activity and investment more than doubling. FinTech investment in Australia in 2022 was 13% above 2020 figures.

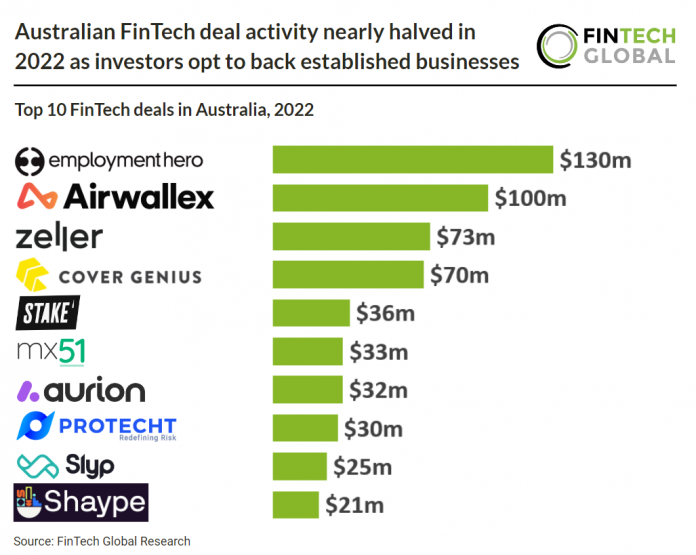

Employment Hero, a cloud-based enterprise software company that provides a platform for businesses to manage HR, payroll, and employee benefits was the largest FinTech deal in Australia during 2022. The company raised $130m in their latest Series F funding round in February 2022. The round attracted investment from AirTree Ventures, OneVentures, and SEEK with each of the investors having long time partnerships with Employment Hero and previously funding the company since 2018. With its new cash injection, Employment Hero’s primary objective for 2022 is to bring its ground-breaking pillars together in ways that will completely transform what businesses and their employees can expect from employment.

Sydney was the most active city in the country with 42 deals announced, accounting for 37% of total FinTech deals in 2022. Melbourne was the second most active with a 23% share and Brisbane was third with 9%. Sydney has a lot of competitive advantages over other cities. Sydney boasts a tech-savvy population and already has an existing financial hub. The city also has an affluent population with attractive lifestyles for its highly educated workforce, making it a prime location for FinTech innovation.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global