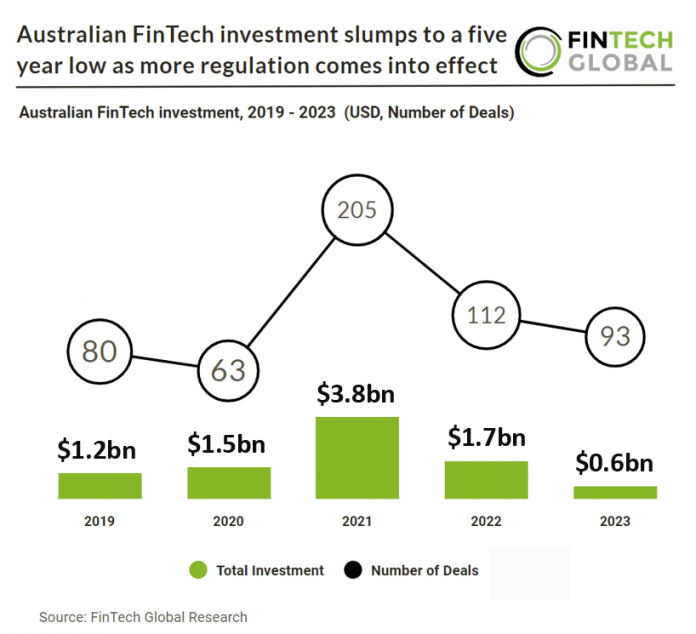

Key Australian FinTech investment stats in 2023:

• Australian FinTech deal activity reached 93 transactions in 2023, a 17% reduction from 2022

• Australian FinTech companies raised a combined $0.6bn in 2023, a 65% drop YoY

• Australian FinTech companies raised a combined $8.8bn over the past five years

In 2023, Australia’s FinTech sector experienced a 17% YoYreduction in deal activity, with a total of 93 funding rounds completed. Funding for Australian FinTech companies also faced a substantial drop, with a total of $0.6bn raised last year, representing the lowest total capital invested in the last five years. Despite these challenges, over the past five years, Australian FinTech companies raised an impressive $8.8bn.

Employment Hero, a provider of HR and payroll services, was Australia’s largest FinTech deal in 2023 after raising $267m in their Series F funding round, with TCV leading the round. The company, which has been in operation for nine years, is now valued at $1.3bn, joining a select group of ten other current unicorns from the country. This new investment enables the company to double down on its mission to make employment easier and more valuable for everyone. The next focus of this is the company’s immediate focus on building AI capability to become a fully autonomous solution for SMEs around the world to manage employment effortlessly. Today, the company takes that dream global, giving SMEs around the world a simple way to solve employment and grow their business without stress.

During September 2023, Australia passed The Financial Accountability Regime (FAR) which introduces significant changes and extended coverage within the financial sector in Australia. FAR replaces and expands upon the Banking Executive Accountability Regime (BEAR), which previously applied only to authorized deposit-taking institutions (ADIs). Now, FAR encompasses banks, insurers, superannuation entities, general insurers, life insurers, private health insurers, and registrable superannuation entities (RSE) licensees, along with their ‘significant related entities.’ This regime identifies all directors and most senior executives as accountable persons, subjecting them to broad obligations such as acting with honesty, integrity, skill, care, and diligence, and taking steps to prevent financial services law contraventions. With dual administration by ASIC and APRA, FAR is expected to result in more enforcement investigations. It applies comprehensively to all aspects of an accountable entity’s operations, from cyber security to anti-money laundering and remuneration. Notably, FAR mandates at least 40% of variable remuneration to be deferred for a minimum of 4 years, introduces increased transparency through a public register of accountable persons, and imposes significant penalties for non-compliance, including substantial fines, potential disqualifications, and regulatory powers to ensure compliance and address non-compliance effectively.