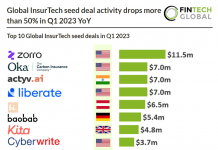

Oka, a provider of insurance solutions for companies in the carbon credit market, has raised over $7m in funding.

The round was led by Aquiline Technology Growth, a prominent investor in early and growth-stage companies that are bringing innovation to financial services, who will help fuel Oka’s vision to ensure all carbon credits are insured.

The round also included Firstminute, a founder-led fund focused on climate tech.

According to Oka, the voluntary carbon market (VCM) is experiencing significant growth and is projected to reach $1trn by 2037, highlighting the scale of the opportunity.

Oka is on a mission to provide insurance that will replace credits if destroyed or invalid, providing security and confidence to the VCM market.

The carbon insurance company provides insurance with the goal of providing security, confidence and protection in an unregulated and opaque market.

The capital will be used to scale Oka’s innovative carbon credit insurance offerings, addressing the risks that large US corporations face when buying carbon credits to offset their emissions and meet net-zero targets.

Chris Slater, founder and CEO of Oka, said, “We are honoured to have the support of Aquiline in accelerating the growth of our company and achieving our vision for making insurance an integral part of the voluntary carbon credit market. With their help, we are confident that we will accelerate the growth of our company and achieve our mission of insuring the transition to net-zero.”

Max Chee, partner and head of Aquiline Technology Growth, added, “Chris and the team at Oka have a compelling vision for maturing the carbon credit market through its insurance offerings. We are excited about our partnership and look forward to seeing the lasting impact Oka will have on the voluntary carbon market.”

Earlier this month, Kita, a London-based carbon credit insurance specialist, raised £4m in funding to leverage InsurTech solutions to support carbon removal projects.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global