UK FinTech investment stats in 2023, as of 2nd March:

• UK companies have raised 35 FinTech seed deals so far in 2023

• Blockchain & Crypto was the most active FinTech subsector in 2023 with a 20% share of transactions

• London was the most active city for FinTech companies raising funding with a 77% share of deals

The UK has seen a weak start to the year with only 35 FinTech companies raising seed deals in 2023, as of 3rd March, a 57% drop from the same period the previous year. Although there were less seed deals in 2023, the average deal size was 92% larger than 2022 levels. London was the most active FinTech city so far in 2023 with a 77% share of deals.

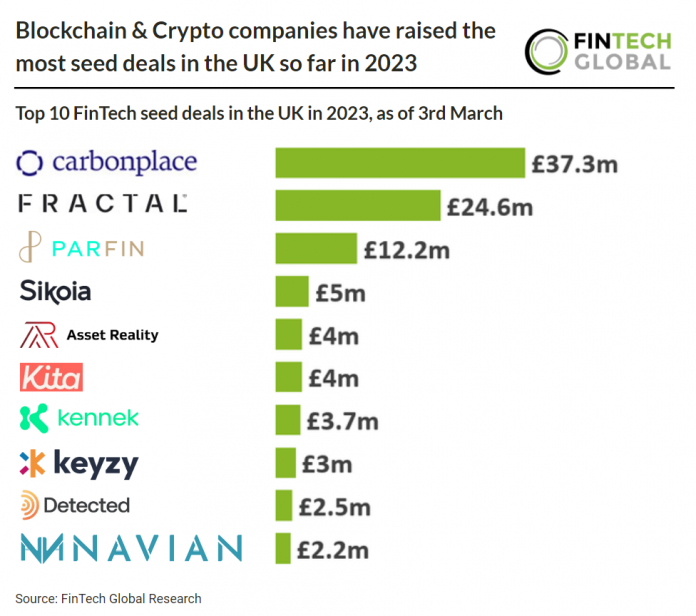

Carbonplace, a global carbon credit transaction network, was the largest FinTech seed deal in 2023, as of 2 March, raising £37.3m from nine investors. The company plans to utilize the funds to increase the size of its platform and team, broaden its range of services to reach a more extensive customer base of financial institutions, and hasten collaborations with more carbon market participants across the globe, such as registries and marketplaces. Carbonplace aims to facilitate the trade of certified carbon credits by connecting buyers and sellers through their banks. The platform, which is set to be launched later this year, will enable immediate transfer of ownership upon payment, ensuring secure and traceable reporting throughout the carbon credit transfer process. This system will be available to financial institution clients who wish to provide their customers with a secure and transparent way to access carbon markets.

Blockchain & Crypto was the most active FinTech subsector in 2023, as of 2 March with a 20% share of total FinTech seed deals. Despite the global drop in Cryptocurrencies which saw Bitcoin declining 70% from its peak in November 2021, UK Cryptocurrency ownership increased 1.2% in 2022 to 6.2% (approximately 4.2m people). The seed deals that raised funding in 2023 were all B2C Crypto companies indicating a continued faith in the technology. The UK HM Treasury said in February 2023 that the government will set out ambitious plans to robustly regulate cryptoasset activities – providing confidence and clarity to consumers and businesses alike.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global