Key UK FinTech seed deals investment stats in 2023

· UK FinTech seed deal activity reached 287 deals in 2023, a 34% drop from 2022

· UK FinTech seed deal companies raised a combined $478m in 2023, a 34% reduction from the previous year

· The average UK FinTech seed deal size in 2023 was $1.7m, no change from 2022

In 2023, the UK’s FinTech sector witnessed a notable decline in seed deal activity, with only 287 deals compared to the previous year, marking a 34% drop. Despite this decrease, companies in this sector managed to raise a combined total of $478 million, reflecting a similar 34% reduction from the previous year. Interestingly, the average size of UK FinTech seed deals remained unchanged at $1.7m, maintaining consistency with the figures reported in 2022.

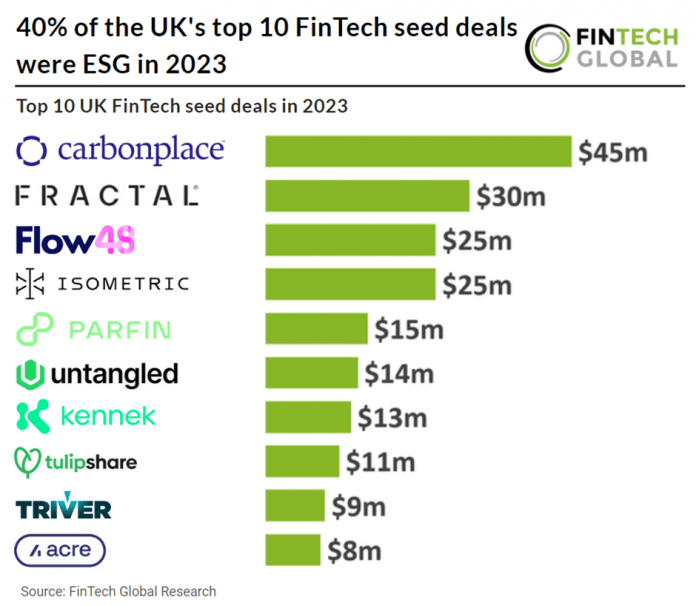

Carbonplace, a global carbon credit transaction network, had the largest UK FinTech seed deal in 2023, raising $45m from nine investors. The company plans to utilise the funds to increase the size of its platform and team, broaden its range of services to reach a more extensive customer base of financial institutions, and hasten collaborations with more carbon market participants across the globe, such as registries and marketplaces. Carbonplace aims to facilitate the trade of certified carbon credits by connecting buyers and sellers through their banks. The platform, which is set to be launched later this year, will enable immediate transfer of ownership upon payment, ensuring secure and traceable reporting throughout the carbon credit transfer process. This system will be available to financial institution clients who wish to provide their customers with a secure and transparent way to access carbon markets.

In 2024, the UK’s Financial Conduct Authority (FCA) is implementing new regulations aimed at enhancing transparency and clarity in sustainable investments. Starting July 31, a labelling regime will be enforced, allowing asset managers and UK funds to apply four different labels to products meeting FCA requirements. Additionally, naming and marketing rules for sustainability-related terms will be enforced from December 2, ensuring product names reflect sustainability characteristics. The highly anticipated anti-greenwashing rule takes effect from May 31, mandating consistency and transparency in sustainability claims. Moreover, regulators are closely monitoring ESG ratings and data product providers, with the launch of a voluntary code of conduct in December 2023, signalling a concerted effort to uphold ESG standards in the financial sector.