German FinTech investment stats in 2022:

• German FinTech investment reached $4.3bn in 2022, a 47% drop from 2021

• FinTech deal activity in Germany dropped 24% to 222 deals from the previous year

• RegTech and WealthTech were the joint most active FinTech subsectors with 33 deals each

German FinTech deal activity and investment saw a drop in 2022 from 2021 levels although both remain above 2020 signalling the investment landscape in the country went through correction rather than a downturn. German FinTech investment in 2022 saw a significant 47% drop to $3.4bn from 2021 levels. FinTech investment in 2022 was still 70% above 2020 levels. German FinTech deal activity saw a less dramatic 24% drop in 2022 reaching 222 deals in total. This drop was slightly more than a comparable country such as France which saw a 17% drop in 2022. Germany was the second most active FinTech country in 2022 behind the UK and ahead of France which was the third most active FinTech country.

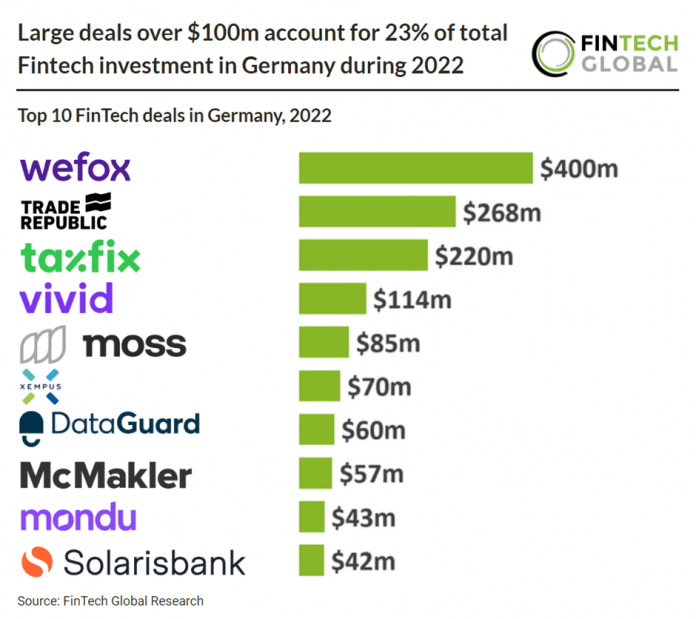

wefox, a fully digital insurer, was Germany’s largest FinTech deal in 2022 raising $400m in their latest Series D funding round led by Mubadala and included seven other investors. This deal represented 11.7% of Germany’s FinTech investment in 2022 and pushed wefox’s valuation to a huge $4.5bn. wefox intends to use the funding for product development and expand across Europe and thereafter Asia and the US. wefox generated $600m in revenue during 2022 and is aiming to double this to $1.25bn in 2023.

Germany’s Federal Financial Supervisory Authority (BaFin) updated their FinTech regulation in September 2022. From January 1, 2023, retail investors in Germany will be protected against unlimited losses when trading futures, thanks to a new general ruling published by BaFin. In order to achieve this objective, the marketing, distribution, and sale of these products to retail investors will be subject to certain restrictions.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global