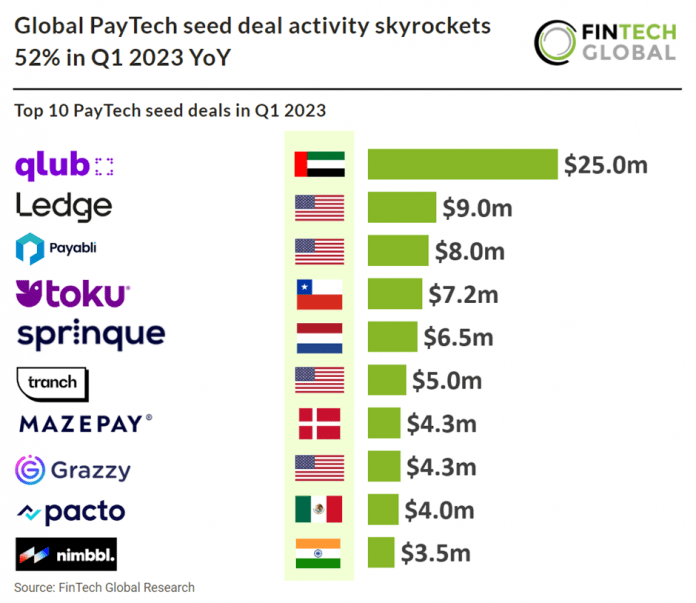

Key PayTech seed deal investment stats in Q1 2023:

• Global PayTech seed deal activity totalled at 53 deals during Q1 2023, a 52% increase YoY

• Average PayTech seed deal size increased 48% to $3.5m in Q1 2023 from Q1 2022

• The United States was the most active PayTech seed deal country in Q1 2023 with a 32% share of deals

PayTech continues to be a disruptive FinTech sector in Q1 2023 despite a global drop in deal activity. As the globe transitions towards a cashless economy VCs clearly think PayTech is at the forefront to benefit. During Q1 2023, the global PayTech industry experienced a remarkable surge with a total of 53 seed deals, marking a remarkable 52% YoY increase. In Q1 2023, the average seed deal size in the PayTech sector witnessed a notable 48% rise to $3.5m, compared to Q1 2022.

Qlub, a payment system to pay the bill at restaurants, was the largest PayTech seed deal in Q1 2023, raising $25m to extend their seed round, led by Cherry Ventures and Point Nine. The startup aims to use the proceeds to fuel growth as well as develop and launch new services for restaurants and customers who already use Qlub, it added. The FinTech has over 2,000 restaurants and has operations in six countries with a notable presence in the UAE, Saudi Arabia and Singapore. Founded in 2021, Qlub allows customers to instantly pay their bills in restaurants within 10 seconds by scanning a QR code with their phone, even without an app or any registration, which increases table turnover, tips for waiters, and returning customers.

With a 32% share of deals, the United States emerged as the most active country in terms of PayTech seed deals during Q1 2023. The UK was the second most active PayTech seed deal country with three deals, a 5% share of total deals in Q1 2023.

The latest Payments regulation comes from the EU on June 28th 2023. The European Commission has proposed new measures to modernize the payment services sector and promote digital transformation which will become PSD3 and establish, in addition, a Payment Services Regulation (PSR). The proposals aim to enhance consumer protection, competition, and data sharing in electronic payments. Key highlights include combatting payment fraud, improving consumer rights, levelling the playing field for non-bank providers, facilitating open banking, and ensuring the availability of cash. Additionally, the proposal establishes a framework for financial data access, allowing customers to securely share their data with financial institutions and fintech firms for better and more affordable financial products and services. The proposal emphasizes customer control over data sharing, standardization of interfaces, clear liability regimes, and incentives for data holders. These measures are expected to foster innovation, competition, and improved access to financial services. The proposal aligns with the Commission’s Retail Payments Strategy and Digital Finance Strategy and supports the broader European data strategy.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global