Key Nordic FinTech investment stats in Q2 2023:

• Nordic FinTech deal activity reached 17 deals in Q2 2023, a 15% drop from the previous quarter

• Nordic FinTech companies raised a combined $49m in Q2 2023, a 70% drop from Q1 2023

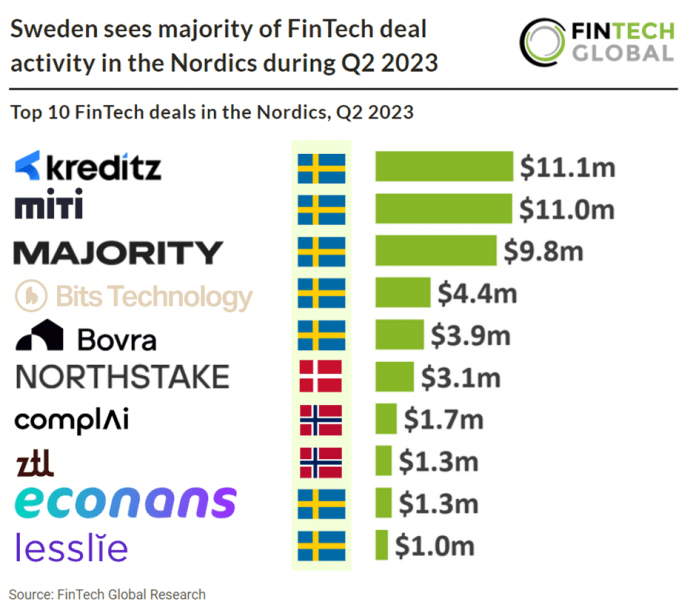

• Sweden was the most active Fintech country in the Nordics with a 71% share of deals

Nordic FinTech has dropped significantly in Q2 2023, similar to other European countries. In the second quarter of 2023, the number of FinTech deals in the Nordic region declined by 15%, totalling 17 deals. Nordic FinTech deal activity dropped 53% YoY. During the second quarter of 2023, Nordic FinTech companies experienced a significant decline in funding, raising a combined $49m. This amount reflects a 70% decrease compared to the funding raised in the previous quarter, Q1 2023.

Kreditz, a data and analytics provider for open banking & PSD2, had the largest Nordic Fintech deal in Q2 2023, raising $11.1m in their latest =venture funding round from Creades AB and Ingka Investments. The company intends to use the funds to accelerate its growth and expansion into new markets.

Kreditz utilizes open banking and PSD2 data to facilitate automated retrieval and analysis of a loan applicant’s current income and expenses. With a customer base of 80 across Europe and the UK, including renowned banking platforms such as Ikea’s Ikano Bank, Collector Bank, DnB, Lendo, and SaveLend, the company has established a strong presence. Having launched in 2019, Kreditz experienced impressive growth last year, with a turnover increase of 278% to approximately SEK 20 million for the full year. In a recent investment round, Kreditz was valued at €40 million. According to Creades CEO John Hedberg, who was an early investor in Tink, a company involved in building the PSD2 infrastructure itself, Kreditz’s innovative solutions provide significant value by building upon the existing infrastructure and delivering finished products that help banks and financial institutions streamline their processes and make more informed customer decisions.

Sweden was the most active FinTech country in the Nordics during Q2 2023 with 12 deals, a 71% share of all deals. Norway was the second most active FinTech country with three deals, an 18% share of deals.

The latest FinTech regulation affect the Swedish CyberTech sector. In 2021, the Swedish Financial Supervisory Authority (SFSA) created a memorandum to outline its role in enhancing cybersecurity and preventing cyber threats in the Swedish financial sector. The SFSA’s efforts aim to contribute to strong cybersecurity measures. Furthermore, FinTech businesses in Sweden may be impacted by the EU’s NIS 2 Directive (Directive (EU) 2022/2555) which has been submitted to enhance security requirements, address supply chain security, streamline reporting obligations, and introduce stricter supervisory measure. The NIS 2 Directive came into effect on January 16, 2023, and must be incorporated into national legislation by October 17, 2024. Following this date, the NIS Directive will be repealed and replaced by the NIS 2 Directive.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global