According to forecasts from the business research company, the market for AI in FinTech would expand at a rate of 28.6% and reach $31.71 billion in 2027. Large Language Models (LLMs), such as Chat GPT from OpenAI are revolutionizing the way FinTech companies operate. Some examples include, personalized chatbots, quick and accurate fraud detection, improved risk assessment for better lending decisions, advanced Natural Language Processing (NLP) for sentiment analysis and customer feedback processing. Additionally, LLMs automate financial analysis, offer personalized recommendations, assist with compliance and regulatory adherence, and boost operational efficiency through automation, providing a competitive edge in the fintech industry.

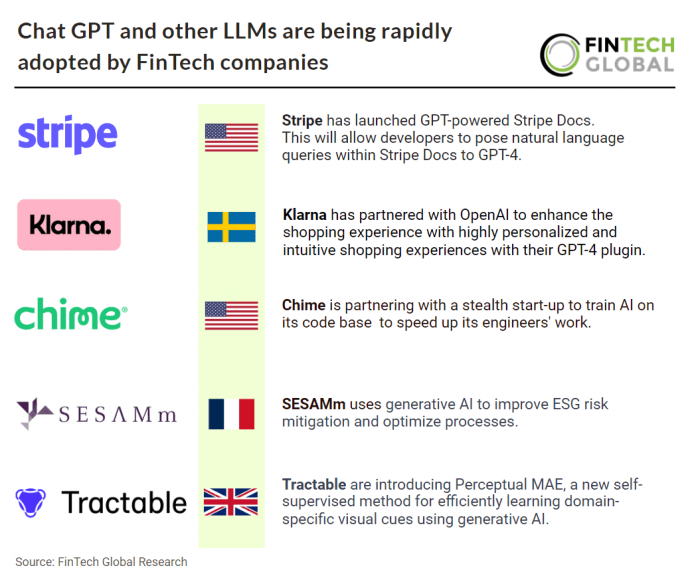

Stripe, an online payment provider, has long used artificial intelligence to enhance its products and experiences for users, including to help users manage fraud and increase conversion rates. After joining the GPT-4 beta in January, Stripe identified a range of ways to use the technology to streamline operations and help users get the information they need, faster. One of the first outputs of this effort is GPT-powered Stripe Docs. This enhancement to Stripe’s high-quality documentation will allow developers to pose natural language queries within Stripe Docs to GPT-4, which will answer by summarizing the relevant parts of the documentation or extracting specific pieces of information. This lets developers spend less time reading and more time building.

Klarna, a prominent global retail bank, payments, and shopping service, has teamed up with OpenAI to enhance the shopping experience. Together, their engineering teams have collaborated to integrate Klarna’s services into ChatGPT, making shopping even smoother. As a pioneer in utilizing OpenAI’s protocol to build an integrated Plugin for ChatGPT, Klarna will offer highly personalized and intuitive shopping experiences. Users can receive curated product recommendations and shopping advice, along with links to purchase products through Klarna’s search and compare tool. This collaboration aims to provide a more seamless and convenient shopping experience for customers.

Chime, a fee-free mobile banking service, is collaborating with a third-party company to train their AI using their own code base within their private cloud. This approach allows them to use the AI in real-world situations without concerns about intellectual property or security issues. Chime has been working with this startup for a short time and is still in the exploratory phase, not having deployed large language models yet to expedite their engineers’ tasks.

SESAMm, a prominent financial technology company, is introducing Generative AI solutions into its operations and products to support financial firms in improving risk mitigation for ESG issues and streamlining processes. Their three-pronged approach includes integrating large language models into their tech stack, developing a client-facing conversational agent, and promoting AI usage across all teams. Already, this integration has led to enhanced product functionality, enabling faster and more intuitive data interaction and introducing new features like ESG/SDG event summarization and automatic competitor searches for public and private companies.

Tractable, which builds ai tools for auto and property industries, are incorporating Perceptual MAE, a new method for efficiently learning domain-specific visual cues using self-supervision as part of their AI 2.0 initiative. The method achieves state-of-the-art performance on ImageNet while being more data and compute-efficient than alternatives. It allows learning from unlabelled data and generalizes across tasks and datasets, making it applicable to various applications. The approach builds on recent advances in self-supervised learning and addresses the grounding problem in computer vision by focusing on higher-level visual cues. The researchers are open-sourcing their approach to encourage further advancements in the field.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global