OpenAI, the trailblazing artificial intelligence enterprise, is set to see its valuation rocket to somewhere in the range of a mind-boggling $80bn to $90bn.

As stated by the Wall Street Journal, the company’s value could rise three-fold, from its current $29bn to around the $90bn. Notably, rather than issuing new shares, existing employees would be given the liberty to sell their current holdings.

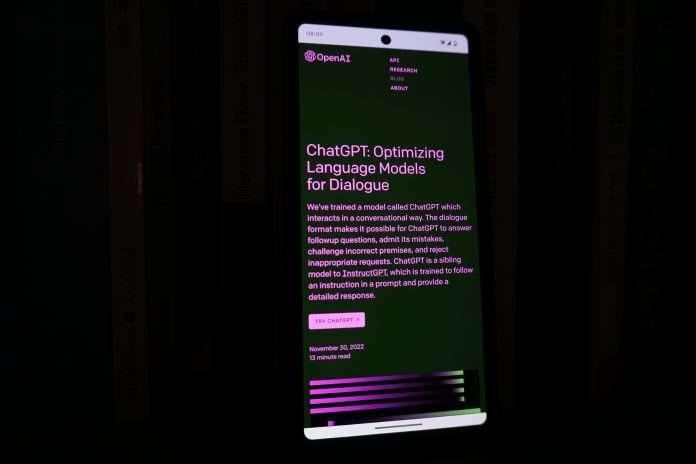

In the dynamic realm of artificial intelligence, OpenAI has carved a niche for itself, particularly with its groundbreaking AI assistant, ChatGPT. Since its debut merely nine months ago, ChatGPT has transformed the technology landscape, enabling individuals to craft essays, poems, and summaries through uncomplicated text prompts.

While specific allocation details of the potential new funding are yet to be announced, OpenAI has consistently shown a penchant for enhancing its offerings. The recent buzz around ChatGPT evolving to facilitate voice interactions with users exemplifies this ethos.

Adding to OpenAI’s series of successes, it was unveiled in late August that the company anticipates a revenue milestone of $1bn in 2023.

Earlier in April, OpenAI secured a commendable funding amount of just above $300m. This significant backing came from reputed names like Sequoia Capital, Andreessen Horowitz, Thrive, and K2 Global, valuing OpenAI at $29bn. Furthermore, the company had also announced a substantial investment from Microsoft earlier this year, which concluded in January. This investment from Microsoft is rumoured to be in the ballpark of $10bn.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global