Key Singaporen FinTech investment stats in Q3 2023

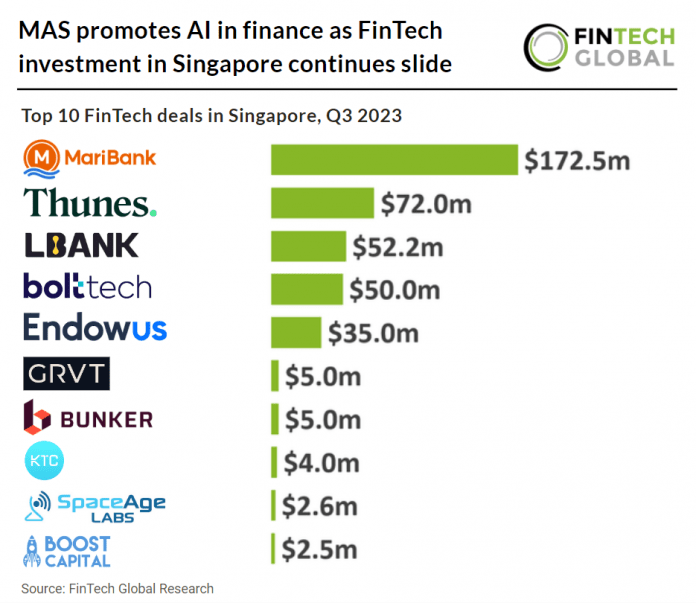

• Singapore’s FinTech deal activity reached 25 transactions in Q3 2023, a 59% drop YoY

• FinTech capital invested in Singapore totalled at $411m in Q3 2023, a 6% decrease from same period in 2022

• Blockchain & Digital Assets, PayTech and WealthTech were the joint most active Singaporean FinTech subsectors in Q3 2023 with five deals each.

Singaporean FinTech has a continued to drop in both deal activity and investment in Q3 2023. In the third quarter of 2023, FinTech deal activity in Singapore plummeted by 59% year-over-year, with only 25 deals recorded. In Q3 2023, Singapore’s FinTech investments amounted to $411m, reflecting a 6% decrease compared to the same period in 2022.

MariBank, a digital bank, had the largest FinTech deal in Singpaore during Q3 2023 after raising $172.5m in their only corporate funding round from Sea Group, which runs Shopee for e-commerce, Garena in gaming, and SeaMoney for digital payments in Southeast Asia & Taiwan. MariBank, which was rolled out in March this year by Sea Group on an invite-only basis, is Singapore’s third digital-native bank. It offers personal savings accounts, business accounts, and business loan products. The bank currently only offers a savings account that earn depositors an annual interest rate of 2.5% — no minimum deposit is required and no minimum spending amount or salary credit is needed.

Blockchain & Digital Assets, PayTech and WealthTech were the joint most active Singaporean FinTech subsectors in Q3 2023 with five deals each, a combined 60% share of total deals.

The Monetary Authority of Singapore (MAS) has revealed the 19 finalists for the “Artificial Intelligence (AI) in Finance Global Challenge” as part of the 2023 Global FinTech Hackcelerator. These finalists have proposed innovative solutions, including the use of cognitive AI for processing financial documents, Large Language Models for generating ESG sentiment analysis, and Generative AI for identifying financial risks. Out of the finalists, 12 were selected through the Local Programme, while seven were chosen from the International Partner Programme, which included global AI-related competitions. During a 10-week program organized by Oliver Wyman, the finalists will collaborate with industry experts to refine their solutions. They will then present their innovations at the Global FinTech Hackcelerator Demo Day at the Singapore FinTech Festival on November 15, 2023. All 19 finalists will receive a cash stipend and a start-up kiosk at the festival, and the top three winners will be awarded cash prizes. Additionally, they can apply for the AISG Start-Up grant, potentially receiving up to S$500,000.