Tag: Oliver Wyman

Marsh McLennan revolutionises supply chain risk management with Sentrisk launch

Marsh McLennan has unveiled Sentrisk, an innovative AI-powered platform designed to revolutionize the way businesses manage global supply chain risk.

Oliver Wyman to boost digital payments expertise with Innopay acquisition

Oliver Wyman, a premier global management consulting firm and a part of Marsh McLennan, has announced its decision to acquire Innopay, a consultancy renowned for its specialisation in digital transactions.

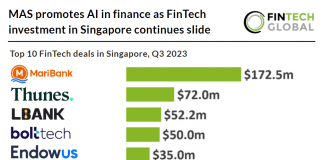

MAS promotes AI in finance as FinTech investment in Singapore continues...

Key Singaporen FinTech investment stats in Q3 2023

• Singapore’s FinTech deal activity reached 25 transactions in Q3 2023, a 59% drop YoY

• FinTech capital...

Driving Financial Crime Detection: The Innovative Adoption of RegTech Tools

Embracing cutting-edge financial crime detection technology is critical for Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) and Fraud teams.

MAS drives AI finance revolution with the 8th Global FinTech Hackcelerator

The Monetary Authority of Singapore (MAS) has announced the commencement of the 8th Global FinTech Hackcelerator.

Driving growth in WealthTech: The critical role of adaptive IT architecture

The WealthTech landscape is undergoing constant transformation. A significant driver of this change is the influx of younger customers due to the great wealth...

Global corporates could save $100bn in yearly transaction costs through CBDCs

A joint report from J.P Morgan and Oliver Wyman has predicted up to $100bn annually could be saved in transaction costs through a central bank digital currency (CBDC) network.

Financial services firms could net a further $700bn annually by better...

Financial services firms can secure over $700bn in additional annual revenue if they better serve women, a study from Oliver Wyman claims.

Majority of FinTech customers happy to switch back to traditional institutions

A majority of FinTech customers would happily use a traditional bank (66 per cent) or insurer (61 per cent) that offered similar services and pricing as a neobank or InsurTech rival, a study from Oliver Wyman claims.

RegTech and dialogue with regulators are the key to compliance

Adopting RegTech and opening dialogue with regulators are both vital in helping the financial services industry achieve compliance according to Subas Roy, partner at Oliver Wyman.