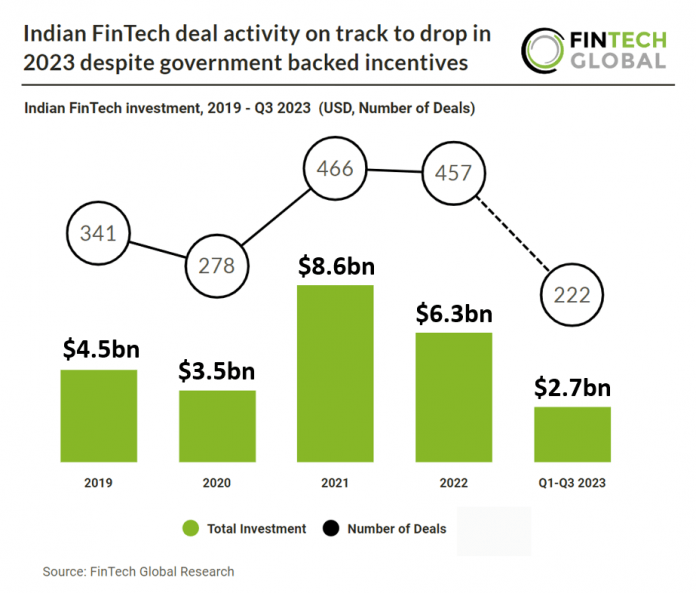

Key Indian FinTech investment stats in Q1-Q3 2023:

• Indian FinTech deal activity reached 222 transactions in Q1-Q3 2023, a 39% drop from Q1-Q3 2022

• Indian FinTech deal activity is on track to reach 296 funding rounds in 2023, a 36% reduction from 2022

• Indian FinTech companies are on track to raise a combined $3.6bn in 2023, a 43% decrease from 2022

Indian FinTech has been affected similarly to the rest of the world with both deal activity and investment on track to decrease in 2023 although at a lesser degree compared to other countries such as the UK. In the first three quarters of 2023, Indian FinTech deal activity saw a 39% decrease compared to the same period in 2022, with a total of 222 transactions. This is better performance compared to other well established FinTech countries such as the UK which saw a 52% drop over the same period. Indian FinTech deal activity is projected to achieve 296 deals in 2023, marking a 36% decline compared to the previous year. Indian FinTech companies are expected to secure a total of $3.6bn in funding in 2023, reflecting a 43% decrease from last year’s figure.

DMI Finance, a digital lending provider, had the Indian largest FinTech deal Q1-Q3 2023, raising $400m in their latest private equity funding round, led by MUFG Bank. According to a release by DMI Finance, it sources and services customers through multiple digital channels and is an embedded digital finance partner of choice for leading businesses including Samsung, Google Pay and Airtel. DMI Finance claims to cover 95% of India’s pin codes and has an accessible customer base of 25m, which is expected to grow to over 40m in FY24. It is expecting to disburse over $2.5bn in FY24.

In India’s 2023-2024 financial budget, the Government of India allocated INR 1,500 crores ($180m) for FinTechs and banks. Earlier, they had announced a separate incentive of INR 2,600 crores ($312m) to support fintech startups and banks, particularly in promoting Unified Payments Interface (UPI) transactions. The government is also taking steps to encourage investments in technology, fintech, and startup sectors. Furthermore, the International Financial Services Centre Authority (IFSCA) introduced an incentive scheme, facilitating access to overseas markets for domestic FinTechs and foreign FinTechs looking to enter IFSCs in India. Additionally, the government proposed various tax-related relaxations, such as extending the deadline for funds relocation to IFSC GIFT City from March 31, 2023, to March 31, 2025.