Tamara, a FinTech platform for shopping, paying, and banking in Saudi Arabia and the GCC region, has bagged $340m in a Series C.

The company has become the Kingdom’s first homegrown FinTech unicorn, securing a substantial $340 million in a Series C equity funding round. This impressive amount was co-led by SNB Capital, a major regional financial institution, and Sanabil Investments, owned entirely by the Public Investment Fund (PIF).

The funding round also saw participation from Shorooq Partners, Pinnacle Capital, Impulse, and others, including existing investors like Coatue, Endeavor Catalyst, and Checkout.com.

Tamara operates in key GCC countries including KSA, UAE, and Kuwait. It boasts over 10 million users, more than 30,000 partner merchants, and has reported a six-fold annual run rate revenue growth in less than two years. Founded in late 2020 by three Saudi co-founders, Abdulmajeed Alsukhan, Turki Bin Zarah, and Abdulmohsen Al Babtain, Tamara has also been one of the first companies to receive a permit from the Saudi Central Bank (SAMA) for BNPL services.

The company intends to use the new funding for further growth and expansion. Tamara’s CEO, Abdulmajeed Alsukhan, expressed his pride in this achievement, saying, “Saudi Arabia deserves its place on the world stage for financial technology. Just as Tamara was created by local entrepreneurs, nurtured by a supportive local ecosystem and market regulators, we stand here today, humbled and hungry, ready for our own leapfrog moment. This achievement is a testament to the ecosystem, to our incredible team, investors, and the collaborative spirit that makes this region a great place for talent to flourish.

“As we set our sights on becoming the next big giant in shopping, payments and banking we remain ever grateful for the significant opportunity in this underpenetrated and underserved banking and financial services landscape.”

A spokesperson from SNB Capital highlighted their role in the funding, stating, “Leading on the Series C raise for Tamara through SNB Capital’s Close-Ended Fintech Fund aligns with one of our objectives to invest in single target companies achieving long-term capital appreciation. Fintech is one of the core investment sectors in SNB Capital’s strategic portfolio and is aligned with the Kingdom’s Vision 2030 objective of supporting fintech entrepreneurs at every stage of their development. As a Saudi unicorn, Tamara requires significant funding options which SNB Capital is ideally positioned to deliver, and backing the development of the fintech infrastructure which will support further growth.”

Tamara has also recently decided to eliminate late payment fees, aligning its financial solutions with Sharia principles, customer centricity, and transparency. This change reflects Tamara’s commitment to a socially responsible business ethos and its dedication to enhancing customer satisfaction and ensuring a seamless, compliant, and reliable financial journey for everyone.

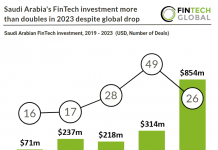

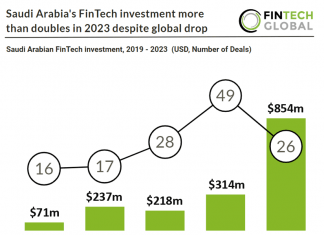

Reflecting on the FinTech sector’s growth in Saudi Arabia and the GCC region, Tamara’s vision aligns with the rapid development occurring despite the challenging global macroeconomy. The current lending penetration in Saudi Arabia is around 30%, indicating significant growth potential compared to mature markets. The region’s thriving e-commerce market and evolving banking sector present abundant opportunities for further expansion.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global