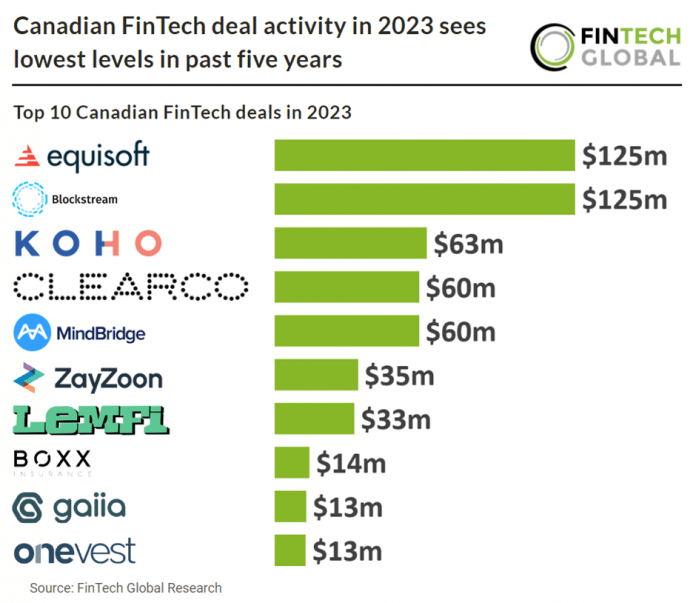

Key Canadian FinTech investment stats in 2023:

• Canadian FinTech deal activity reached 144 deals in 2023, a 48% reduction from 2022

• Canadian FinTech companies raised a combined $808m in 2023, a 76% drop from the previous year

• RegTech was the most active FinTech subsector with a 48% share of total deals

In 2023, the Canadian FinTech sector experienced a significant decline in deal activity, with only 144 deals recorded, marking a notable 48% reduction compared to the previous year. This downturn also extended to fundraising efforts, as Canadian FinTech companies collectively secured $808 million in funding, reflecting a substantial 76% drop when compared to the funding levels of the previous year.

Equisoft, a Montreal-based insurance and investment software developer, had the largest Canadian FinTech deal in 2023 after raising $125m in their latest private equity funding round. Of the total investment $70m came from new investors Investissement Québec and the government of Québec, with the remainder coming from Export Development Canada and Fondaction. Equisoft said the new funding will contribute to its global expansion, both organically and through strategic acquisitions. Established in 1994, Equisoft has positioned itself as a pioneer in driving digital transformation within the life insurance sector and has emerged as a prominent player in the realm of wealth and investment management technologies. From its inception in Montreal, Quebec, Equisoft has consistently prioritized not only its financial expansion but also its commitment to generating positive economic, social, and environmental influences. Equisoft CEO, Luis Romero, said, “Digital transformation and customer experience projects are no longer optional. Equisoft’s mission is to help companies through this process – at any stage of digital maturity – by delivering the most trusted solutions for complex financial services challenges. Our customer focused approach has enabled us to gain the confidence of some of the largest financial institutions around the world.

RegTech was the most active FinTech subsector with 70 deals, a 48% share of total deals. This was followed by Blockchain & Digital assets which saw 33 deals raised, a 22% share of total deals. Lending Technology and WealthTech were the joint third most active subsectors with 26 deals each, a 18% share of total deals.

In 2024, Canada is poised for significant developments in payments and open banking, marking the culmination of years of consultation and regulatory framework development. The implementation of the Retail Payment Activities Act (RPAA) is a pivotal event this year, with a mandatory registration requirement for all payment service providers (PSPs) with a window between November 1 to 15, 2024. This regulation has a broad scope, encompassing PSPs in Canada and even those abroad conducting retail payment activities for individuals or entities in Canada. The RPAA defines five payment functions, and individuals or entities performing any of these functions may qualify as PSPs. Compliance with the RPAA is crucial, and those planning to engage in in-scope payment activities must register at least 60 days before commencing such operations, underlining the regulatory significance of this year in the Canadian payments landscape.