Key European InsurTech investment stats in 2023:

• European InsurTech deal activity totalled at 126 deals in 2023, a 44% reduction from the previous year

• European InsurTech companies raised a combined $823m in investment during 2023, a 84% drop from 2022

• The UK was the most active European InsurTech country with 46 deals, a 37% share of total deals

The European InsurTech sector has seen a significant drop in both deal activity and investment during 2023. In 2023, European InsurTech witnessed a significant decrease in deal activity, with only 126 deals, marking a 44% decline compared to the previous year. European InsurTech firms faced a substantial decrease in investment, securing a total of $823m in 2023, reflecting an 84% drop from their 2022 funding levels. A BCG report indicated that some product lines, notably personal property and casualty (P&C) and health insurance, have reached a stage of relative maturity and now have lower expectations of private investment growth.

Quantexa, which provides data analytics for anti-money laundering, had the largest European InsurTech deal in 2023, raising $129m in their latest Series E funding round, led by GIC. In what has been a difficult period for many tech companies, Quantexa continues to post impressive growth, having grown their ARR over 100% since closing their Series D round. In the same time period, Quantexa has seen robust growth in all regions, including a breakout performance in North America, with an increase in ARR of over 180%. This new capital will ensure that Quantexa continues to grow its global presence and invest in its world-class engineering talent. Quantexa also plans to use the funding to boost technology innovation efforts and strengthen its Decision Intelligence Platform capabilities in low-code data fusion, graph analytics, machine learning (ML), natural language processing (NLP) and artificial intelligence (AI). Additionally, Quantexa will increase focus on accelerating joint go-to-market efforts with its flagship partners which include Google, Moody’s, Accenture, KPMG, Deloitte, and EY.

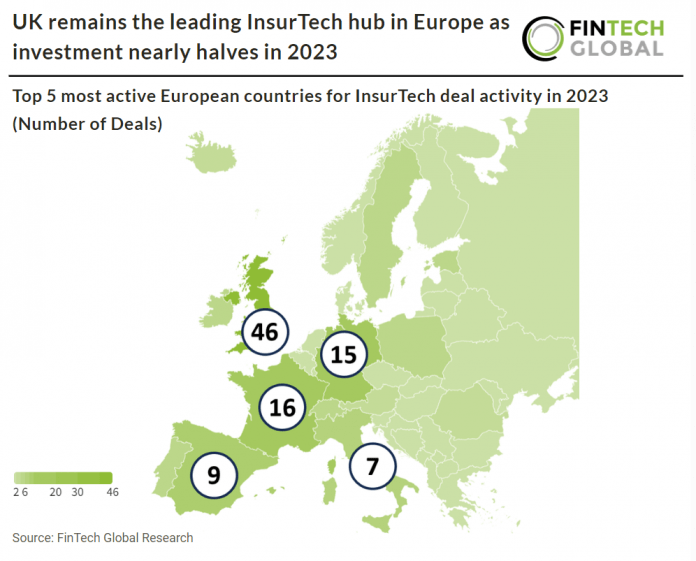

The UK was the most active European InsurTech country with 46, a 37% share of all funding rounds. France was the second most active with 16 deals, a 13% share and Germany was third with 15 deals, a 12% share. Spain was the fourth most active with nine deals, a 7% share and Italy was fifth seven deals, a 5.5% share.

The UK’s Financial Conduct Authority (FCA) has finalized rules for insurance firms regarding the transfer and replacement of retained EU law provisions from the Insurance Distribution Directive (IDD). The FCA is replacing IDD delegated regulations with its own rules and guidance, ensuring continuity in the regulatory framework for insurance-related activities. These changes apply to all firms involved in insurance activities and will be effective from April 5, 2024. The FCA’s actions stem from the UK’s exit from the EU and the need to repeal IDD delegated regulations while maintaining necessary requirements. This follows consultation in CP23/19 to address the transition.